Welcome to the 32nd Edition of The Bitcoin Newsletter

Apart from Strategy (previously Microstrategy (MSTR)), the Bitcoin treasury company that has most caught my attention is Metaplanet. Their pivot from traditional real estate to digital real estate feels like a logical response to post-COVID regulatory and inflation challenges in the hotel industry, especially for those of us active in real estate development.

The timing of this pivot couldn’t have been better; taking place just before Bitcoin gained broader mainstream traction and as the real estate sector began grappling with rising interest rates.

Additional elements for a successful shift are a sharp execution team, a solid treasury strategy, and a growing investor community. As we’ve seen with Strategy, retail sentiment plays a major role in the success of a Bitcoin treasury company.

In this 32nd edition of the newsletter, I will delve into the story of Metaplanet, serving as an example of how companies can follow Strategy’s playbook in adopting a Bitcoin treasury strategy.

The insights I’ve gained writing this piece will be included in a corresponding chapter of my upcoming book Digital Real Estate. The release is planned for Q1 2026, and as a subscriber to my newsletter, you’ll be the first to know.

Like my Deep Dive on Strategy, this newsletter is my most comprehensive written piece yet.

It was important to me to understand the Metaplanet story in its entirety and I want to share that with the community.

If this story is as significant as it appears, it deserves a closer look, not just as a company, but as a potential framework for understanding global Bitcoin adoption. You can jump between the headings or skip the DEEP DIVE, as the IDEA OF INTEREST section contains a number of videos and other material on the topic.

My goal is to explore how Bitcoin is being integrated into traditional capital structures across major financial centers.

A complete list of resources can be found at the end of the article. You can find my most recent podcast appearances in the WORTH TO KNOW section.

Best regards,

Leon

DEEP DIVE

The Metaplanet Story: From a crisis to a Bitcoin Standard

Introduction: The Origin Story

As real estate evolved into a financial asset, particularly after the U.S. effectively abandoned the quasi gold standard in 1971, which triggered worldwide monetary inflation, many investors turned to property ownership as a hedge against inflation, making it the world’s preferred store of value.

Succeeding in real estate has required more than just the ability to build and manage properties; it has necessitated a deep understanding of inflation, credit, debt, interest rates, money, currency, and broader financial markets. That is why The Strategy Playbook and the Metaplanet story offer such important insights for real estate investors.

Metaplanet has its roots in the hospitality sector. It was originally established as Red Planet Japan, the Japanese subsidiary of Red Planet Hotels, a budget hotel chain headquartered in Bangkok and founded on June 11, 1999, with operations across Southeast Asia, including in Japan, Thailand, Indonesia, and the Philippines.

Simon Gerovich, one of Red Planet’s co-founders and now President & Representative Director of Metaplanet, led the group’s entry into Japan in 2013 by acquiring a company listed on the Tokyo Stock Exchange. That entity was rebranded as Red Planet Japan and served as the platform for the group’s expansion into the Japanese market.

For several years, Red Planet Japan thrived, managing a portfolio of 30 hotels across Japan and assets in Thailand acquired from its parent company, Red Planet Hotels. Then, in 2020, COVID-19 delivered a crushing blow to the hospitality sector. Metaplanet was forced to suspend operations in three of its four markets, with revenues collapsing and activity grinding to a halt.

By late 2023, the company was in severe distress. Japanese regulators issued a going concern warning, typically triggered when a company lacks sufficient cash to operate for the next 12 months, casting serious doubt on its ability to survive.

Gerovich has stated that he had been following Bitcoin since 2012, even having lost coins on Mt. Gox, the major Tokyo-based exchange that infamously was hacked and collapsed in 2014, Amid this crisis with Red Planet, Gerovich proposed a bold pivot: sell off the hotel assets except one, recapitalize with bitcoin, and adopt a corporate Bitcoin standard. Metaplanet, the Bitcoin treasury company, was born.

Inspired by Michael Saylor’s Strategy (MSTR), the company rebranded as Metaplanet and, in April 2024, officially transitioned into a Bitcoin treasury company by allocating ¥1 billion (~$6.5M) into bitcoin. The hotel subsidiary was formally liquidated in May 2024.

From then on, Metaplanet has employed a capital-raising strategy that includes equity issuance, option trading and preparing long-term debt financing, to fuel bitcoin accumulation.

In a traditionally conservative market, Metaplanet emerged as Japan’s first unapologetic Bitcoin company. What began as a post-COVID zombie company with one hotel and a pile of tax losses transformed into a rising star of Bitcoin finance, growing its market cap from $14 million to over $1 billion in less than a year. But is this remarkable growth sustainable? Let’s break down what they’ve done.

Simon Gerovich

Much like Strategy, Metaplanet’s Bitcoin story began as an attempt to survive a crisis. At the time still operating as Red Planet Japan, a hotel chain, the company was backed into a corner. COVID decimated the hotel industry, and with near-zero occupancy, bankruptcy loomed.

Bitcoin offered a lifeline. But in conservative Japan, that path demanded conviction and the courage to defy convention. Metaplanet CEO Simon Gerovich brought a rare blend of high finance and entrepreneurial grit.

He is an Australian citizen, born to an Australian father and a Taiwanese mother. His upbringing across Asia was shaped by his father’s career as a diplomat and East Asia specialist. After completing high school in Beijing, Simon Gerovich went on to earn a degree in Applied Mathematics from Harvard University. He then moved to Tokyo, where he began his career as a derivatives trader at Goldman Sachs.

Five years later, he left finance to build Red Planet, a hotel company he co-founded in Thailand in 1999, before re-entering the Japanese market to lead Red Planet Japan in 2013.

During the COVID crisis, Gerovich came across Michael Saylor’s Bitcoin thesis, and it struck a nerve. As his tangible hotel business faced existential pressure, he began exploring Bitcoin as a corporate treasury asset. Thanks to adopting a Bitcoin standard, Metaplanet emerged as the best-performing stock in the world in 2024, delivering over 2,075% in yen returns to shareholders, according to yahoo finance.

Dylan LeClair & Team

Gerovich is supported by a top-tier team. Dylan LeClair, a long-time Bitcoin savant and wizard-analyst in his twenties, joined Metaplanet as Director of Bitcoin Strategy in May of 2024.

Drawing inspiration from Michael Saylor, LeClair led the development of a capital accumulation strategy centered on aggressive but disciplined treasury expansion. Using a mix of equity and debt instruments, Metaplanet rapidly grew its bitcoin holdings.

Dylan isn’t the only standout hire at Metaplanet. Shinpei Okuno, Head of Capital Strategy & Investor Relations, also makes a strong impression. Add to that a growing list of partnerships with well-known brands, companies, and personalities in the Bitcoin space, including UTXO Management, EVO Fund, and Bitcoin Magazine.

But, what truly sets Metaplanet apart is their unapologetic transparency and ability to galvanize retail interest.

From Hospitality to Hard Money

Metaplanet’s transformation from a hospitality firm into a Bitcoin treasury company has breathed new life into the business, redefining its corporate DNA and showcasing how struggling small-cap firms can revitalize themselves through a well-executed Bitcoin treasury strategy.

By focusing on bitcoin per share (BPS) as its core performance metric, Metaplanet has created a scalable, capital-efficient growth model, balancing risk and return.

BTC Yield measures the increase in bitcoin per fully diluted share over time, capturing how effectively a company grows its bitcoin holdings relative to its total share count.

Why Japan Is the Perfect Soil for a Bitcoin Treasury Company

Japan's unique economic landscape created the ideal conditions for Metaplanet's strategy. With interest rates near zero, a rapidly debasing currency, and nearly $9 trillion sitting in household bank accounts earning little to no real interest, Japanese investors are hungry for yield.

Japan’s record-high debt-to-GDP ratio (261%) and years of ultra-loose monetary policy, including negative interest rates from 2016 until early 2024 and aggressive bond-buying by the Bank of Japan, have severely weakened the yen, which has lost 50% of its value against the U.S. dollar over the past decade.

This created a policy paradox: the Bank of Japan prints yen to suppress borrowing costs, then intervenes to prop up the currency it just weakened. It floods the system with yen to stimulate growth, only to buy yen back to prevent collapse, a self-canceling loop that risks becoming unsustainable under capital flight or inflation pressure.

Bitcoin offers a compelling alternative, but unfortunately it's hard to access. Buying bitcoin in Japan is burdensome: registration can take up to six weeks, requires heavy documentation, and involves a postcard confirmation of the investor’s address.

This stems partly from regulatory overcorrection after the Mt. Gox collapse. Based in Tokyo and once the world’s largest bitcoin exchange, Mt. Gox imploded in 2014 after losing 850,000 bitcoin to hacks and mismanagement. The scandal severely damaged Bitcoin’s reputation in Japan and led to strict regulations that stifled adoption for years.

In addition, Japanese investors face steep taxes on direct bitcoin gains. In Japan, gains on bitcoin are treated as miscellaneous income (雑所得, zatsu shotoku) and are subject to progressive taxation, up to 55%, the highest rate globally. In contrast, capital gains on securities are taxed at a flat rate of just 20%.

By purchasing Metaplanet shares, investors can gain bitcoin exposure in a far more tax-efficient way. Shares bought tax-free through Japan’s NISA system (Nippon Individual Savings Account) are even more advantageous. Investors can contribute up to ¥3.6 million annually ($23,000), split into a ¥1.2 million Tsumitate Quota (for mutual funds) and a ¥2.4 million Growth Quota (for stocks, ETFs, REITs, etc.). Within these limits, gains are tax-free and investments can be held indefinitely.

Unlike holding bitcoin, most Japanese equities, including Metaplanet, can also be traded with leverage, making them even more attractive for those seeking amplified exposure.

These factors have helped Metaplanet evolve into a proxy for bitcoin in Japan, accessible through traditional brokerage accounts. It has quickly become a retail favorite and has attracted institutional attention, serving as the de facto way for stock traders to express and gain Bitcoin conviction, even if they weren’t Bitcoiners at first.

In a financial culture known for its conservatism and caution after Mt. Gox, Metaplanet’s unapologetic, Bitcoin-only strategy stands out as radical and refreshing.

While holding an equity with bitcoin exposure isn’t the same as holding bitcoin directly, since the self-sovereign benefits are stripped away, most investors, especially in a conservative market like Japan, prefer to operate within regulated, familiar frameworks. This preference is driven by the clear tax and pricing advantages of having exposure to bitcoin via publicly traded stocks like Metaplanet.

Over the past 15 months, many Metaplanet shareholders have become Bitcoiners, orange-pilled by price appreciation and the company’s relentless transparency.

Japan is yield starved. Metaplanet can feed that hunger. With a fortress balance sheet backed by bitcoin, along with rising liquidity and trading volume, it has the ability to build the capital markets layer Japan has been waiting for. That demand is already showing up.

In the first week of June 2025, Metaplanet was the #1 most bought stock through NISA accounts at SBI Securities, Japan’s largest online broker.

The combination of tax-free bitcoin exposure and access to leverage has made Metaplanet Japan’s ultimate bitcoin proxy.

What also works in Metaplanet’s favor is that Japan uses fair value accounting, which allows companies to report unrealized gains on their balance sheets.

When bitcoin appreciates, those gains can be reflected directly in financial statements. Sparking strong market interest and renewed excitement around the stock.

After nearly seven years of losses, Metaplanet posted a breakout quarter in early 2025. This means that as bitcoin gains purchasing power, it directly improves the company’s reported financials, boosting both balance sheet strength and investor confidence.

In a market as conservative and slow-moving as Japan’s, the infamous Mt. Gox hack severely damaged public trust and cast a long shadow over Bitcoin adoption. With Metaplanet, Japan is likely to become again a major shining force in Bitcoin’s global story.

How Metaplanet Educated Regulators and Institutionalized Bitcoin Strategy

According to Dylan LeClair, Japan’s regulators were initially baffled: “You’re a hotel company; why are you buying bitcoin?” Metaplanet responded with data, disclosures, and precedent, pointing to companies like Tesla, Strategy, and Semler Scientific.

They went on to establish a formal business line, Bitcoin Treasury Operations, giving future equity issuances and bitcoin purchases clear regulatory context. They also published a bold, Bitcoin-only manifesto on the Tokyo Stock Exchange, signaling their maximalist intent:

“Metaplanet views bitcoin as fundamentally superior to any and all other forms of political currency, traditional stores of value and investment, and all other crypto-assets/securities. … Bitcoin’s monetary policy is rigidly set in stone …, setting it apart from both monetary metals and competing crypto projects operated at the whims of centralized developer teams. There will only ever be 21,000,000 bitcoin.”

Strategic Treasury Transformation and Bitcoin Adoption by Metaplanet

This proves that Bitcoin can be integrated into regulated business structures, if you’re willing to lead.

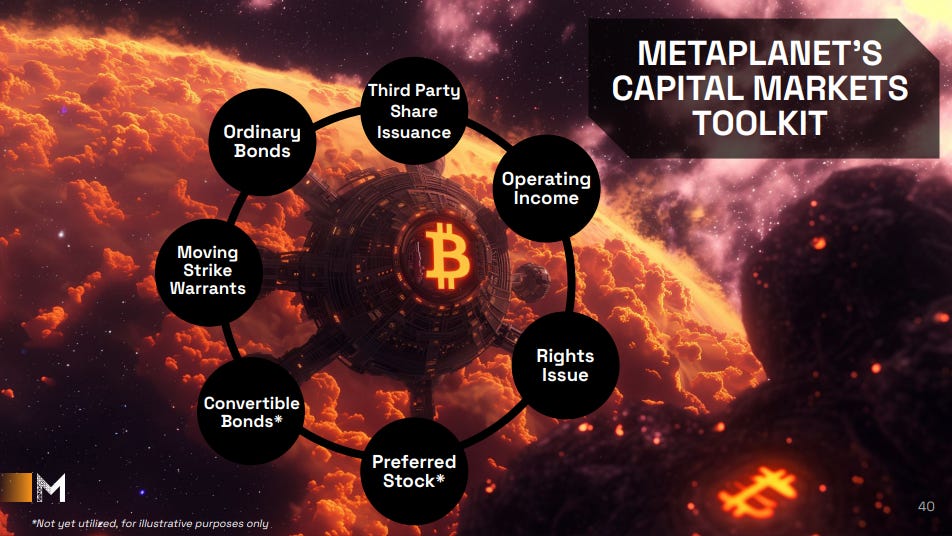

Key Instruments Used for Capital Raising:

In June 2025, Metaplanet launched Asia’s largest-ever equity raise dedicated solely to bitcoin accumulation: a ¥770.9 billion ($5.4 billion) capital campaign via 555 million shares to be issued.

A first of its kind, made possible by Metaplanet’s high volatility, volume and deep liquidity. The stock’s volatility allows them to create more favorable terms for the issuing partner.

This initiative follows the highly successful 21m Plan, which raised ¥93.3 billion (~$650 million) in just 60 trading days, boosting BTC yield by 189%, and more than tripling the stock price.

Metaplanet now ranks as the fifth largest public bitcoin holder globally, with forward targets of 100,000 bitcoin by the end of 2026 and 210,000 bitcoin (1% of all bitcoin that will ever exist) by the end of 2027.

The capital-raising instruments employed by Metaplanet reflect the unique characteristics of Japan’s capital markets, stock issuance and fundraising mechanisms are subject to stricter regulatory constraints, a topic explored in more detail below.

This makes Japan an particularly instructive example of how Bitcoin can be adopted at the corporate level within a highly regulated environment, shedding light on a path that many companies still hesitate to take.

1. Initial Bitcoin Purchases: Cash, Hotels, and Rights Issuance

To accelerate its transition to a Bitcoin standard, Metaplanet sold nearly all of its hotel assets, retaining just one property in Tokyo, primarily to preserve tax losses that can be used to offset future gains. They even issued a bond against that remaining asset to unlock additional capital for bitcoin purchases.

The company now positions bitcoin as its core treasury reserve asset, strategically using both equity and debt financing to maximize shareholder value.

After deploying its cash reserves, along with proceeds from hotel sales and a bond issuance, into bitcoin, Metaplanet turned to accredited investors and then launched a traditional rights offering to raise additional capital. The early capital raise was designed to attract investors who understood and supported its Bitcoin-centric mission.

Among them was UTXO Management, the investment firm founded by David Bailey, CEO of Bitcoin Magazine. UTXO’s involvement, along with that of other aligned backers, helped validate Metaplanet’s strategy in its formative phase. I’ll explore their role in more detail later.

After completing the raise from accredited investors. Metaplanet mailed 15,000 physical envelopes to existing shareholders, offering them the right to purchase new shares at a discounted price of ¥555 ($3.50), while the market price stood at ¥600 ($3.80). In a wave of grassroots enthusiasm, over 13,600 investors mailed them back and wired funds, an over 90% response rate.

Remarkably, in defiance of the efficient market hypothesis (EMH), the stock price rose after the issuance, rather than adjusting downward toward the average of the existing and discounted share prices, highlighting strong investor confidence in Metaplanet’s Bitcoin strategy. Though analog and resource-intensive, the campaign validated massive retail demand and seeded a loyal shareholder base.

Japan imposes strict limits on equity dilution, capping new share issuance at four times the current publicly traded shares (float). Starting with just a $14 million market cap (¥2 billion), Metaplanet had to operate carefully within these regulatory bounds.

Unlike U.S. firms such as Strategy, which can issue shares freely via At-The-Market (ATM) facilities, Japanese companies lack such open-ended tools. An ATM allows companies to sell newly issued shares incrementally into the open market at prevailing prices, providing flexible, real-time access to capital without a fixed offering size.

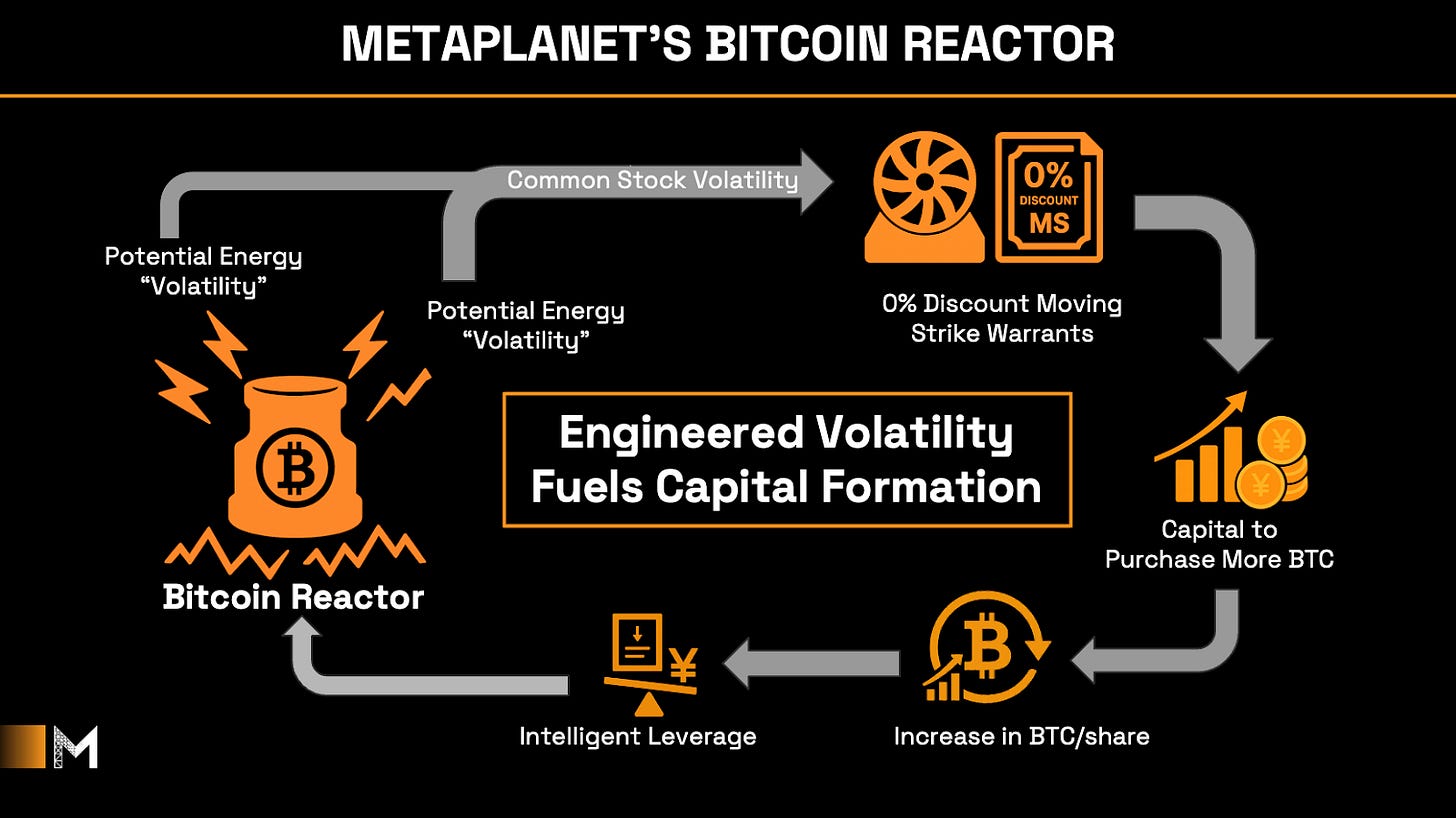

To work around this, Metaplanet adopted Moving Strike Warrants, a structure common in Japan that functions similarly to an ATM by issuing shares dynamically based on market conditions. This mechanism will be described in the following section.

2. Moving Strike Warrants

To raise capital for bitcoin purchases within the confines of Japan’s strict financial regulations, Metaplanet has turned to a mechanism called Moving Strike Warrants, a workaround that mimics the functionality of an At-The-Market (ATM) equity facility.

While traditionally used by struggling companies, Metaplanet repurposed the tool to its advantage, using it to acquire bitcoin and boost bitcoin-per-share value for shareholders, making the move accretive.

To navigate Japan’s rigid capital markets, where flexible, real-time equity issuance like in the U.S. isn’t allowed, Metaplanet partnered with one of its major shareholders, Evolution Financial Group (EVO), a Cayman Islands–based investment firm.

Starting in December 2024, they began executing a repeatable capital-raising strategy using Moving Strike Warrants, which allow EVO to purchase newly issued shares at prices based on recent market activity.

How the EVO-Metaplanet Share Issuance Works in Practice

Step 1: Short Sale Initiated

EVO borrows shares from Metaplanet’s largest shareholder, MMXX Ventures, and immediately sells them on the open market at the current price, say, ¥100.

→ This creates a short position: EVO now owes MMXX the same number of shares.

Step 2: New Share Purchase via Warrant

At the same time, EVO holds a warrant agreement with Metaplanet, allowing it to purchase newly issued shares at a price based on a previous closing price, e.g., ¥98.

→ EVO locks in a fixed purchase price slightly below the current market price.

Step 3: Short Position Closed

Once Metaplanet delivers the newly issued shares (typically on T+2 settlement), EVO uses those shares to return to MMXX, closing the short.

→ EVO effectively sold high (¥100) and bought low (¥98), capturing a ¥2 per share spread with minimal market risk.

Step 4: Capital Flows Into Bitcoin

The proceeds from the new share issuance flow directly to Metaplanet, which immediately deploys the capital to purchase bitcoin, increasing its corporate treasury holdings.

The Result: Key Benefits of the Structure

For Metaplanet

Shares are issued only during positive price momentum → minimizing market impact.

Each new share directly increases bitcoin per share (BPS) → accretive dilution.

The market responds positively as bitcoin exposure per share increases.

Traditional Japanese warrants often require an 8–10% discount to attract interest. Metaplanet avoids this by leveraging its volatility and trading volume, allowing EVO to profit from small intraday spreads, without any discount, potentially in exchange for future warrant exclusivity.

For EVO

Low-risk arbitrage with predictable intraday spreads (e.g., ¥2 per share).

Exclusive access to warrant issuance.

As Metaplanet’s third-largest shareholder, EVO has a vested interest in boosting bitcoin per share and driving sustained demand for the stock.

For MMXX

Lends shares without having to sell, retaining exposure and voting rights.

Supports Metaplanet’s treasury growth a without diluting its own position.

Likely receives loan fees or revenue participation.

Why it works

Metaplanet issues shares in small increments during upward momentum, allowing market demand to absorb supply. This rolling strategy funds bitcoin accumulation while minimizing disruption and maximizing long-term shareholder value.

Each issuance increases bitcoin per share, a metric Metaplanet has nearly doubled every 90 days since adopting its Bitcoin standard in April 2024.

EVO, despite being technically short, acts as a strategic partner, not a speculator, facilitating capital raises without significant dilution or price impact.

Limitations of the Model

Metaplanet’s strategy works best in bitcoin bull markets with high trading volume. If the stock falls below the warrant exercise price, issuance can pause, reducing capital inflow. As seen with Strategy in 2022, bitcoin equities may briefly lose demand, but downturns are often followed by sustained recoveries.

Historically, bitcoin bear markets last 8–12 months, while bull markets stretch about three years. The challenge is using bull phases wisely to build resilience for the next cycle.

Conclusion of the Model

The structure is a repeatable, market-driven model that turns volatility into capital formation. It enables efficient bitcoin accumulation with minimal market disruption, while aligning Metaplanet with some of its major shareholders, EVO and MMXX.

Unlike the GameStop craze, where dilution eroded investor interest, Metaplanet’s accretive issuance boosts bitcoin per share and reinforces long-term demand.

Metaplanet’s two standout capital raises: The 21m Plan and the 555 Plan

Launched in January 2025, the 21M Plan aimed to issue 210 million shares and became Japan’s largest-ever warrant issuance, raising ¥93.3 billion (~$650 million) in 60 trading days.

This drove Metaplanet’s bitcoin treasury from 1,762 BTC to about 7,800 BTC by May 2025, a 189% increase in BTC per share, propelling it into the top 10 global public bitcoin holders.

This validated the model, helped educate regulators and investors, and built the volume needed to support its next phase: the 555 Plan.

Unveiled in June 2025, the 555 Plan aims to raise ¥770.9 billion (~$5.4 billion) via 555 million shares, the largest bitcoin-focused equity raise in Asia supporting Metaplanet’s goal of reaching 210,000 BTC by end-2027 and ultimately 1% of all bitcoin.

The warrants are issued at a 1–3% premium, not at a discount, and are priced off a rolling 3-day volume-weighted average price (VWAP) to smooth volatility.

Every 72 hours, the strike price resets based on the latest VWAP; if the stock gaps up, the warrants reprice with it, bringing in additional fiat that’s promptly converted into bitcoin.

EVO accepts the premium because it secures pricing in advance, enables low-risk arbitrage, and allows for large-scale execution without market disruption, aligning with Metaplanet’s strategy and EVO’s long-term role.

Together, the 21M and 555 Plans form a fast, accretive, and scalable model for treasury growth. Even with potential dilution of up to 92%, rising demand for regulated bitcoin exposure continues to push market cap and bitcoin per share higher.

EVO has historically been one of Metaplanet’s largest shareholders and remains a primary capital partner. In addition to facilitating Moving Strike Warrants, EVO also underwrites bonds and provides liquidity in the stock, playing a central role in Metaplanet’s capital formation strategy.

3. Zero-Coupon-Bonds

Metaplanet issued zero-coupon bonds, debt sold at a discount and redeemed at face value, allowing it to raise capital without immediate interest payments. This frees up cash for bitcoin purchases, especially when equity issuance is restricted under Japan’s strict regulations.

These bonds are typically purchased by aligned, long-term investors such as EVO and MMXX Ventures, historically one of Metaplanet’s largest shareholders. MMXX helps to bridge traditional financial infrastructure with the Bitcoin and crypto ecosystem.

The company provided a ¥1 billion ($6.8M) shareholder loan at just 0.1% interest in 2024, enabling timely bitcoin buys during market dips.

CEO Simon Gerovich holds voting rights in MMXX but refrains from using them for Metaplanet-related decisions.

The company’s capital strategy is rooted in alignment: shareholders want to see bitcoin per share increase, and Metaplanet can achieve this more efficiently than individual investors due to its scale, tax advantages, and access to financial instruments.

Metaplanet’s close relationship with long-term investors like EVO and MMXX provides access to 0% loans, offering the flexibility to buy bitcoin on down days, even when Moving Strike Warrants aren’t usable.

As major shareholders, these investors benefit directly from Metaplanet’s bitcoin accumulation, aligning incentives across the board. This structure not only supports strategic purchases but also enhances future capital-raising capacity.

Given Japan’s low-rate environment, zero-interest bonds aren’t unusual. And while Japan isn’t facing hyperinflation, persistent inflation and policy interventions have created an unstable equilibrium, making bitcoin exposure increasingly attractive.

4. Options Strategy & Bitcoin Income

Metaplanet allocates 5–10% of its capital to bitcoin options, primarily by selling cash-secured puts, not to accumulate discounted bitcoin, but to generate steady, bitcoin-denominated income. If bitcoin stays above the strike price, Metaplanet keeps the premium; if it falls below, the company buys at a level aligned with its long-term treasury goals.

For example, with bitcoin trading at around $100,000, an investor might pay Metaplanet $1 today for the right to sell bitcoin at $60,000 later. If bitcoin never reaches that level, Metaplanet keeps the $1. If it does, the company purchases at $60,000, a strategically sound entry point. The objective, however, is income, not accumulation.

This approach also fits well with Japanese corporate culture, where demonstrating profitability is culturally significant. Generating visible income, even from a Bitcoin-based strategy, builds trust with both regulators and investors by aligning with domestic expectations of a “successful” company.

As outlined in the section on Metaplanet’s future opportunities, this income strategy could support 2–4% interest payments on fixed-income products.

For instance, with $5 billion in bitcoin holdings and $250–500 million in cash, Metaplanet could generate a 15–20% annual yield from selling bitcoin options, equivalent to $40–100 million per year. That could support up to $500 million in preferred fixed-income securities, backed by $100 million in annual income and used to acquire more bitcoin.

Because all options are fully cash-secured, this strategy carries no more financial risk than holding bitcoin directly. It also complements the Moving Strike Warrant model by generating income during flat or declining markets, supporting consistent bitcoin-per-share growth through all phases of the cycle.

Notably, Strategy avoids this approach due to U.S. regulations: options income could trigger reclassification as an investment company. As a business intelligence firm, that would contradict its identity and mandate.

Metaplanet, by contrast, has greater flexibility as a Japanese operating company. Strategic yield generation through options may be one of the most underappreciated tools in a Bitcoin treasury company’s arsenal.

The Flywheel Effect: What Drives It?

Asian investors have embraced Metaplanet as the region’s long-awaited Bitcoin proxy, while global investors are drawn not just to its bitcoin exposure, but to its experienced leadership, including figures like Dylan LeClair from the U.S. Bitcoin space.

Metaplanet is one of the most volatile stocks on the Tokyo Stock Exchange, hitting its daily trading limits nearly 40 times in a year. These sharp moves, triggering limit up/down halts under Japanese rules.

This means the stock price moved so sharply in one direction that trading was temporarily halted under Japanese exchange rules. Attracting attention, liquidity and volume.

Metaplanet capitalizes on this volatility through flexible tools like Moving Strike Warrants, zero-coupon bonds, and options-based arbitrage, enabling continuous bitcoin accumulation at various price points.

In fiat systems, volatility is seen as risk. But in truth, it’s the price of opportunity, an integral part of growth. Like an athlete who improves through recovery, cycles of tension and release are essential to resilience.

Metaplanet, and Bitcoin itself, recognize volatility not as a threat, but as a signal. Embracing these cycles revives a kind of financial vitality that supports long-term human flourishing.

Bitcoin Treasury Flywheel & Accretive Dilution

Metaplanet has engineered a self-reinforcing capital engine, a Bitcoin treasury flywheel. By leveraging an elevated market value of equity relative to bitcoin holdings (mNAV), the company can issue new equity at a premium, and acquire bitcoin to boost its bitcoin per share metric in the process.

For example, with a 5x mNAV, even a modest dilution can result in a 3–7x stock move, without any change in bitcoin's price. The stock doesn't need to move because the company is effectively acquiring more bitcoin per share than it is issuing, amplifying bitcoin exposure per fully diluted shares. Investors value that leverage.

By increasing the BTC yield, Metaplanet has transformed its Bitcoin treasury into a business model, capitalizing on early-stage adoption and investor demand for regulated exposure.

A high mNAV during this early stage of Bitcoin adoption, amplified by the current bull phase, allows a publicly listed company to raise capital well above the value of its existing bitcoin reserves, enabling it to acquire more bitcoin per unit of shareholder dilution.

Metaplanet’s strategy turns traditional NAV logic on its head. Unlike properties, REITs and real estate funds, which typically trade close to 1.0x NAV, and rarely does a real estate fund trade above 1.5x, Metaplanet has traded at 5–8x its bitcoin holdings.

This premium allows the company to issue equity at a multiple of its underlying asset value and acquire bitcoin at market price (1.0x NAV), effectively arbitraging investor demand.

The result: explosive NAV growth and share price despite dilution. By selling high and buying fixed-supply bitcoin, Metaplanet turns speculative momentum into a powerful engine for asset accumulation, something almost unheard of in traditional real estate markets.

This strategy isn't without risk. As Metaplanet grows and the market matures, its mNAV multiple is likely to compress. In bear markets, it could even fall below 1.0x mNAV, making equity issuance dilutive rather than accretive.

To weather such periods, public Bitcoin companies must maintain a considerably low debt ratio and build meaningful cash reserves. This is why having an adjacent cash-generating business proves valuable.

Steady operating income can bridge periods when capital markets lose interest in bitcoin equities, helping the company avoid forced bitcoin sales or value-destructive dilution. Successful Bitcoin companies, whether public or private, must plan not just for bull cycles, but for resilience in downturns.

Metrics

There are several metrics used to evaluate the performance of a Bitcoin treasury company.

BTC Gain: Measures the increase in the absolute number of bitcoin held.

BTC Gain in Fiat: Reflects the fiat value of the accrued bitcoin.

BTC Yield: Tracks the increase in bitcoin per fully diluted share.

BTC Rating: Measures how many times a company's bitcoin reserves cover its liabilities.

mNAV: Ratio of market cap to bitcoin holdings. A high mNAV (>1) allows a company to issue equity at a premium, acquiring more bitcoin than it gives up in shareholder value. In bull markets, 2x is accretive, 3x is exceptional. Sustained high mNAV signals trust and execution strength.

Bitcoin Torque: Measures how efficiently a company converts fiat into bitcoin exposure. Formula: value of bitcoin stack / total dollars spent. A torque >1 means capital deployed has created more than equivalent bitcoin value.

Days to Cover mNAV: Introduced by Adam Back, this metric shows how long it takes to earn back the market premium (mNAV) through bitcoin per share growth. For example, Metaplanet's Days to Cover mNAV is ~75 days, meaning it takes 75 days for the company to accumulate enough new bitcoin per share to accumulate the premium the market has assigned to them.

Later, James Check proposed a refinement called Days to Replace mNAV, which aims to address certain edge cases where Days to Cover may produce distorted results. The core idea behind both is to quantify how quickly BTC-per-share growth can justify a company’s market premium.Premium Compression Velocity (PCV): Introduced by Adam Livingston, it measures how fast a company is burning through its premium, turning perceived overvaluation into real bitcoin gains per share. Driven by BTC Yield growth. PCV complements Days to Cover mNAV by adding a time-based lens into capital efficiency.

Metaplanet has demonstrated strong metrics across these categories, with rapid bitcoin per share growth, high BTC Yield, and efficient capital conversion.

Future Plans

In addition to its Bitcoin-focused operations, Metaplanet retained ownership of a hotel in Tokyo, originally for strategic tax purposes, using past losses to offset future gains.

Now, the property is being transformed into The Bitcoin Hotel, a globally accessible, Bitcoin-standard hospitality experience.

Set to open in Q1 2026, it signals Metaplanet’s intent to merge real-world infrastructure with Bitcoin-native principles and builds on the precedent of Hotel Princess in Plochingen, Germany, the world’s first Bitcoin hotel.

Bitcoin’s Entry into Fixed Income: Japan’s Untapped Frontier

In Japan’s yield-starved environment, fixed income innovation is overdue, and Metaplanet is uniquely positioned to lead. With interest rates hovering near zero, traditional fixed-income products offer little return, and the market for preferred equity is virtually nonexistent.

When presenting at the Bitcoin for Corporations Summit in 2025, Gerovich said, “Japan is completely yield-starved, if I offered local investors even a 2% coupon, they’d bite my arm off to get it.”

Only four perpetual preferred or bond-type class shares currently trade in Japan, highlighting the scarcity of this market segment.

These include ITO EN (~3.17–3.4% yield), SoftBank Series 1 (2.5% yield), SoftBank Series 2 (3.2% yield), and INFRONEER (~1.85–1.88% yield).

This scarcity creates a wide-open opportunity for Metaplanet to pioneer Bitcoin-backed preferred equity offerings in a market with minimal competition and strong demand for yield.

Metaplanet could step in by issuing bitcoin-backed preferred stock. In Japan, where the non-investment-grade credit market is virtually nonexistent and returns on traditional debt remain chronically low, bitcoin-collateralized securities could unlock an entirely new asset class.

Issuing long-dated debt or preferred equity with just a 2-4% yield would already outperform most domestic alternatives.

Unlike Strategy, which must pay for preferred yields by issuing more preferred or common shares, Metaplanet already generates income through its options strategy, harvesting bitcoin volatility into additional bitcoin and cash.

For example, with $5 billion in bitcoin holdings and $250 million in cash generating 15–20% annual percentage yield (APY) from selling bitcoin options (or $40–50 million annually), Metaplanet could issue $1 billion in preferred shares and immediately deploy $750 million into new bitcoin purchases.

Meanwhile, the $50 million annual yield obligation on the preferreds would already be covered by the company’s existing income stream. However, this strategy isn’t without risk.

In a sharply falling market, relying on cash-secured put selling to service debt could backfire. If bitcoin's price drops significantly, Metaplanet may be obligated to purchase bitcoin with that cash.

Consuming cash reserves just as downside volatility spikes. This could strain liquidity and impair the company’s ability to meet fixed-income obligations, raising the risk of a negative feedback loop if not carefully managed.

This cycle could continue, expanding the bitcoin treasury, income streams, and preferred share base together, reducing reliance on common stock issuance.

Over time, this could help make bitcoin a foundational corporate asset in Japan, not just as a treasury reserve, but as collateral for loans, structured products, and potentially even institutional reserves.

Looking ahead, Metaplanet’s ambition to hold 1% of all bitcoin by 2027 could give it the leverage and credibility to issue new types of financial instruments.

Convertible Bonds: Japan vs. U.S. Mechanics

In the U.S., companies like Strategy have used convertible bonds to raise capital for bitcoin purchases. These instruments appeal to convertible arbitrage funds, which buy the bonds, short the stock to hedge exposure, and profit from volatility and credit spreads.

While holding and converting into common stock can deliver bigger upside in a bull market, funds prefer arbitrage for its predictable, hedged, repeatable returns. This structure lets companies raise capital efficiently while minimizing immediate dilution.

Metaplanet, however, is moving more cautiously, given its smaller market cap. With 90–140% stock volatility, issuing convertibles too early would likely attract too many arbitrageurs and too few mission-aligned partners.

That’s why, at this point in time, Metaplanet is prioritizing equity raises and exploring bond issuance with strategic allies. Preferred equity may follow as the next step in building a disciplined, Bitcoin-native capital structure.

Global Recognition and Institutional Flow

Metaplanet’s story has gone global. The company has been added to some ETFs in the U.S. and Europe, and included in the MSCI Japan Index, as fund managers seek to capture its outsized growth potential.

U.S. and Asian institutional investors see it as a regional analog to Strategy. This boosts liquidity and legitimizes the Bitcoin treasury model worldwide.

Metaplanet’s stock trades nearly 24/5 across Japan, Germany, and the U.S. (OTCQX: MTPLF), echoing Bitcoin’s always-on nature.

For now, the company benefits from growing U.S. investor demand via OTC trading, but it cannot yet raise capital directly from the U.S. market. Something a future NASDAQ uplisting and formal U.S. presence aims to change.

U.S. Expansion via Miami Subsidiary

Metaplanet continues to expand its global footprint with the establishment of a wholly owned U.S. subsidiary, Metaplanet Treasury Corp., based in Miami, Florida.

Strategically designed to access U.S. institutional capital, take advantage of a more crypto-friendly regulatory environment, and support around-the-clock operations across global time zones.

The Bitcoin Magazine Partnership

Seeing the cultural and educational vacuum in Japan, Metaplanet licensed Bitcoin Magazine Japan. To build a native Bitcoin culture. It’s a Bitcoin-first, education-driven media outlet, creating the groundwork for cultural adoption, just as Metaplanet created the financial vehicle.

Key Capital Partners Metaplanet Works With

Metaplanet has attracted capital allocators including Capital Group and Norges Bank. These firms see Metaplanet as a rare and strategic Bitcoin proxy in Asia, combining aggressive treasury growth with regulatory clarity.

This institutional interest is amplified by Metaplanet’s deep integration into a Bitcoin-native financial ecosystem led by David Bailey.

Bailey, who acquired Bitcoin Magazine in 2015 through BTC Inc., transformed it into the most influential media and conference platform in the Bitcoin space.

In 2019, he launched UTXO Management as the asset management arm of BTC Inc., bringing on Dylan LeClair, now Head of Bitcoin Strategy at Metaplanet, as an Analyst. Dylan must have been around 18 at the time. UTXO was also the first major Bitcoin-native firm to invest in Metaplanet.

To meet growing demand for public Bitcoin exposure, Bailey launched the Bitcoin for Corporations network, helping treasury-led companies amplify their strategies through the Bitcoin Magazine brand.

All of these initiatives sit under BTC Inc., which also operates UTXO Management and the Bitcoin for Corporations platform, as far as I understand.

In 2025, Bailey launched Nakamoto ($NAKA), a publicly listed Bitcoin holding company created through a reverse merger with KindlyMD Inc.

Its first major move was acquiring BTC Inc. and its subsidiaries, including Bitcoin Magazine, UTXO Management, and their stake in Metaplanet. The firm is embedded in the very infrastructure powering institutional Bitcoin adoption worldwide.

Becoming a Bank

In a recent podcast, Simon Gerovitch hinted at Metaplanet’s potential evolution into a bitcoin service provider, an idea tied to their ambition of becoming the world’s second-largest holder of bitcoin. In this second phase, the company could leverage its pristine bitcoin balance sheet to finance strategic acquisitions within the Bitcoin ecosystem.

This might include pursuing a regional digital banking license, acquiring an existing bank, or offering specialized bitcoin-related financial services. Once that kind of balance sheet is in place, the possibilities expand dramatically.

Fundamentally, it should be emphasized that the Bitcoin treasury model is primarily about acquiring and focusing on holding bitcoin. Any additional role in supporting the broader Bitcoin ecosystem remains speculative for now.

Speed, Size, Retail, Visibility & AI

Metaplanet is a small, agile organization. The core team at the Japan headquarters consists of eight employees. In addition to that, there are separate teams managing Bitcoin Magazine Japan and the hotel operations, bringing the total number of people involved across all business areas to around 20.

A big shift from the company’s earlier structure, which included over 1,000 staff across four countries. By plugging into the Bitcoin network, growth and global reach are possible without the burden of massive overhead.

When Metaplanet adopted a Bitcoin standard, its equity was held by just a small number of shareholders. Today, that number has grown to over 123,000, a surge driven by rising investor confidence and demand for regulated or leveraged bitcoin exposure.

Metaplanet’s explosive growth is a direct reflection of Bitcoin’s network effect. Each new shareholder increases Metaplanet’s capacity to raise capital and acquire more bitcoin, effectively turning equity demand into bitcoin accumulation.

While these investors may not hold bitcoin directly, they gain price exposure via a tax-advantaged, compliant vehicle within Japan’s traditional financial system. In doing so, they not only share in bitcoin’s upside, they also help strengthen the network. This is Bitcoin adoption, at scale, through a regulated structure.

Metaplanet’s success isn’t just the result of strong leadership and sharp execution, it also comes down to world-class communication and marketing.

The company actively engages with retail investors through a dedicated YouTube channel, their own podcast, regular appearances at conferences, and consistent interaction on X. Community-led groups like Metaplanet Madness on X and the Metaplanet Dojo on Discord further amplify this engagement.

Their marketing is subtle but powerful, full of hidden messages and symbolic references. The 555 Plan plays on the Japanese pronunciation go-go-go, echoing their aggressive bitcoin accumulation strategy.

The 21m Plan references Bitcoin’s 21 million hard cap. Milestones like holding 5,555 or 8,888 BTC were marked with announcements that resonated with the Bitcoin community’s love of symbolism, numerology, and meme culture.

They’ve packaged themselves not just as a company, but as a story: a planet aligned with Bitcoin, aiming for the moon.

It’s a message that resonates deeply with a new generation of retail investors, independent analysts, and Bitcoin-native thinkers, many of whom CEO Simon Gerovich directly engages with on X.

In a space dominated by traditional finance, Metaplanet speaks the language of the Bitcoin era, clear, timely, and transparent.

It certainly adds strength that Dylan LeClair, Metaplanet’s Bitcoin Strategist, has long been a respected voice in the Bitcoin community.

He’s a frequent and well-liked guest on podcasts, able to articulate the company’s story clearly and convincingly, and he comes across as genuinely likable while doing so. Strategy proved how crucial it is for a Bitcoin treasury company to rally a grassroots following; it drives sustained demand for the stock.

Metaplanet is radically transparent: every treasury move is announced in advance, slide decks and full playbooks are shared with the community.

By openly publishing their strategy, just as Saylor did, they harness a positive network effect: each new participant makes the Bitcoin network stronger and more resilient, benefiting everyone involved.

That radical transparency doubles as a marketing tool, with every update published fueling investor sentiment and driving further engagement on social media.

While I've already seen what a retail community can achieve with Tesla, and Strategy, the speed at which it has grown around Metaplanet is unseen in my lifetime. I believe this is partly driven by the rise of AI.

Tools like ChatGPT have empowered so-called uninformed retail investors to quickly grasp complex strategies and regulatory structures, even faster than traditional finance. This accelerated understanding translates into rapid engagement and demand. Metaplanet is a retail phenomenon, a product of our time.

It also empowers analysts and podcasters to research, synthesize, and present these ideas more effectively, helping to amplify the Metaplanet story to a wider audience. AI is transforming how we digest complex information and dramatically speeding the pace at which those insights reach the public consciousness.

Community building is essential for Bitcoin treasury companies to gain traction. Without an engaged investor base, they’ll never trade above 1.0x mNAV. Liquidity, in turn, attracts more investors, sustains momentum, and allows companies to raise additional capital.

In Japan, this dynamic is even more critical: companies may only increase their authorized share capital up to four times their issued shares without a shareholder vote.

To go beyond that 4x limit or to issue shares above their current authorization, they need a special resolution requiring a two-thirds majority at a general meeting. Building a strong, loyal community is therefore not just advantageous but necessary to advance the Bitcoin treasury strategy, secure shareholder support, and maintain the flexibility needed to grow.

Deep Bitcoin literacy and robust shareholder support thus become the engine that drives both share-price performance and long-term treasury growth.

In the IDEAS OF INTEREST section below, you’ll find some of my favorite Metaplanet related content.

Lessons for Real Estate Entrepreneurs

Metaplanet treasury model leverages volatility, regulatory arbitrage, and a Bitcoin-first identity to turn a dying hotel firm into a Bitcoin proxy.

A key aspect of Metaplanet’s Bitcoin treasury model, pioneered by Strategy, is capitalizing on the spread between the value of the company’s stock and its bitcoin holdings, similar to how real estate investors leverage the spread between outstanding debt and the nominal value of their properties.

However, bitcoin serves as better collateral because it increases in purchasing power much faster than real estate, due to its absolute scarcity, allowing for capital formation at an unprecedented rate.

Traditional real estate cycles often take 3–5 years from acquisition to development and eventual cash flow, while Metaplanet executes bitcoin purchases in days. The most productive capital allocation I have seen.

Since April 2024, Metaplanet has executed over 60 bitcoin buys, averaging two per month.

All companies today their business and highly competitive environment were earning at that point in time This approach has allowed the company to double its bitcoin per share exposure roughly every 60 days, highlighting the unmatched efficiency and compounding potential of a Bitcoin-native capital model.

It also carries less risk than a traditional real estate development, where one typically takes on 4–5x leverage upfront, together with significant risk to build, then lease, sell, and potentially manage the property.

In contrast, Metaplanet raises capital predominantly by issuing equity, which, aside from dilution, which in their case is accretive, carries no direct risk.

The company can then deploy that capital to purchase bitcoin within just days. An asset that requires no tenants, no sales process, and little maintenance. At the time of writing, Metaplanet has a debt to bitcoin holdings ratio of around 1%, meaning that it could absorb the debt even if bitcoin’s value dropped by 99%.

A remarkably conservative position. In real estate, it's common for projects to carry 60–80% debt ratios, often with multi-year development timelines and substantial execution risk.

By contrast, Metaplanet's strategy offers near-instant exposure to a fixed-supply asset, with a balance sheet so conservative that it could theoretically absorb the entire debt even if bitcoin dropped 99%. Compared to the leverage and risk profile of traditional hotel deals, this is not only innovative, it’s structurally far less risky, with significantly higher upside potential.

Holding bitcoin as collateral gives a Bitcoin treasury company a unique advantage: as Bitcoin appreciates, the debt-to-equity ratio improves naturally over time. That said, the same volatility that powers the engine upward also carries risk on the way down.

Bitcoin bear markets can be brutal. Certain patterns tend to repeat, and once understood, they can’t be avoided or predicted, but managed. It remains to be seen how Metaplanet performs in a downturn.

For real estate investment firms whose primary objective is financial return, who chose real estate for its leverage, tax advantages, and income upside within the fiat system, pivoting toward a Bitcoin-focused strategy can unlock growth potential at a scale 1000x faster and larger than conventional real estate investing, as seen in Metaplanet’s playbook.

However, for project developers, builders, and architects, those in real estate not purely focusing on capital efficiency, but because they build, the role of bitcoin is different. Here, bitcoin serves best as a strategic tool to reinforce the business model:

The Metaplanet story offers powerful lessons, but the application is different. For builders, Bitcoin doesn't need to replace the core business, it can strengthen it.

Private investments in real estate and bitcoin offer privacy-preserving wealth-building opportunities. Going public requires embracing a less private route. But, it opens the door to vast opportunities in the global capital markets.

The Metaplanet Case: Solving the Housing Paradox

The rise of Bitcoin treasury companies has sparked controversy, and rightly so. Don’t trust, verify. Nonetheless, speculation is a natural part of human behavior and, by extension, of markets.

What’s remarkable is that when channeled through Bitcoin, speculation can produce powerful second-order effects. Metaplanet is proof. As I’ll lay out, speculation doesn’t have to distort, it can help build. Speculation is a natural part of any financial system.

In fiat markets, though, it creates negative side effects, especially in real estate. Because property is scarce and easy to leverage, it gets used as a store of value, an inflation hedge against constant monetary debasement.

This drives up housing costs and distorts the market, turning homes into financial instruments instead of places to live. Bitcoin offers a more efficient alternative.

Capital that once inflated real estate prices can now flow into Bitcoin, or into companies like Metaplanet, whose business models are built on top of it.

Whatever you think of Metaplanet, it’s a real-world example of the positive second-order effects of Bitcoin: speculation no longer has to drive up housing prices.

Metaplanet offers equity-based access to bitcoin. This isn’t the same as holding BTC directly, because it strips away its self-sovereign qualities.

However it reflects how individuals operate in traditionally over-regulated markets like Japan. Metaplanet offers bitcoin exposure where it’s needed and where it was previously inaccessible due to regulation or lack of trust.

After the collapse of Mt. Gox, the first major Bitcoin exchange, based in Japan, bitcoin possession in the country became tightly regulated, with gains taxed as income at rates up to 55%.

By contrast, shares in bitcoin-holding companies are taxed more favorably. Held in a NISA (Japan’s tax-advantaged pension account), exposure up to ≈$15,000/year can even be tax-free. This offers an accessible entry point, and a path to deeper understanding.

Unlike real estate, bitcoin doesn’t require physical occupancy to hold value, no one has to live in bitcoin for others to benefit from its appreciation, which means speculative demand doesn’t drive up the cost of living. This makes bitcoin a far less distortionary store of value.

As speculation shifts from real estate to Bitcoin, such as in the case of companies like Metaplanet, capital is being redirected into more sound infrastructure, rather than inflating the cost of living.

In Japan, speculation in housing isn’t as big of an issue due to an aging population and a large number of vacant homes.

But globally, real estate is often used as a store of value, pushing up housing costs, a dynamic Bitcoin can help alleviate.

The second-order effects of Bitcoin adoption are powerful. It challenges the logic of traditional real estate investing in a bitcoin-denominated world and allows real estate to return to utility-based pricing.

Ultimately with the opportunity to make housing affordable.

Why Not Bitcoin Directly?

Together, Strategy in the U.S. and Metaplanet in Japan are helping connect two of the world’s largest economies to the Bitcoin network.

Since Bitcoin and central banking are fundamentally incompatible, this connection happens not through direct monetary integration but through equity offerings and fixed-income products.

Because of regulatory uncertainty, lack of institutional trust, and limited understanding barriers still exist. Bitcoin-backed equities and structured financial products bridge this gap, offering investors regulated, and sometimes tax-advantaged exposure.

This offers an accessible entry point, and a path to deeper understanding. Often, seeing the solution reveals the problem. As investors experience Bitcoin’s benefits, many come to recognize the value of itself-sovereign properties. That shift can help rebuild trust in a country still wary, a crucial step for an economy grappling with ongoing debasement.

Even if investors don’t directly benefit from bitcoin’s self-sovereign properties, they still gain exposure, not just to its price, but to its underlying philosophy.

In addition, Metaplanet’s success shows there’s an alternative path for speculation, one that doesn’t drive up the cost of living like fiat-based speculation in scarce assets such as housing. Instead, speculation happens on top of Bitcoin, reinforcing its network effect and adoption.

While this strips holders of bitcoin’s self-sovereign qualities, it channels natural human behavior, speculation, so that it benefits Bitcoin rather than distorting essential goods, like housing.

In Japan, a market still marked by the Mt. Gox fallout, this kind of regulated, accessible exposure is important. Bitcoin finds people when and where they need it, or perhaps more accurately, people find Bitcoin when they're ready.

One underappreciated angle is the role of institutional capital mandates. Many institutional investors are constrained by narrow mandates, U.S. convertible bond funds, for example, can only invest in U.S. domiciled convertibles, regardless of better opportunities elsewhere.

This creates siloed pools of capital, effectively locked into specific geographies or instruments. Bitcoin-backed financial products tailored to meet these mandates can unlock those pools.

By designing yield-generating instruments that fit within institutional frameworks, like Strategy has done with STRK, STRF, and STRD, Bitcoin treasury companies can create category killers that siphon institutional capital into Bitcoin-aligned vehicles.

Metaplanet, and others like it, can replicate this playbook in their own markets.

The Ethical Concerns Behind the Speculative Attack

Many Bitcoiners, who are well aware of the problem of monetary expansion and the resulting inflation, may feel uneasy about raising large sums of capital from banks, money that may not have previously existed and could contribute to the devaluation of outstanding savings.

However, borrowing money does not necessarily mean creating new money. Instruments such as convertible bonds or preferred stock, for example, can be privately placed and issued to individual investors who want to allocate their savings.

This means that these strategies can be executed without unnecessarily feeding into the debt and monetary devaluation spiral of the fiat system. These concerns are logical and understandable.

Personally, I believe everyone must find a strategy that aligns with their own expectations and moral compass. Given that every yen or dollar spent is ultimately debt, each person must decide how much debt they are comfortable with.

If one chooses to accumulate bitcoin, doing so with debt seems to be economically sound, it’s a rational decision. In fact, it almost begs the question: why wouldn’t you?

Bitcoin, along with the principles of the Austrian School of Thought, which emphasize ethics and individual responsibility, can offer meaningful guidance in making such personal decisions.

Risks

Custody

According to Simon Gerovitch, Metaplanet uses multiple licensed custodians to safeguard its bitcoin. They regularly share their custodial and public wallet addresses for transparency.

Japanese law requires companies to custody bitcoin with regulated entities, limiting the ability to self-custody.

While this is a trade-off, regulated exposure means no self-custody, it comes with meaningful benefits for a publicly listed corporation and its shareholders: easy access, and lower taxes.

Metaplanet assures that it continues to diversify its custody arrangements within regulatory constraints to enhance both security and trust.

ETFs and Market Competition

Metaplanet’s stronghold in Japan remains a major competitive edge. With no local bitcoin ETFs, listed miners, or comparable public companies, Metaplanet is currently the only bitcoin proxy in Japan's equity markets. However, that could change quickly.

The introduction of a Japanese bitcoin ETF would offer tax-efficient exposure and potentially divert attention.

That said, the effect may be positive, similar to what happened in the U.S. with Strategy when the first bitcoin ETFs launched in early 2024.

Strategy saw a surge in interest and a record-breaking year. ETFs tend to broaden market interest in Bitcoin, attracting more capital to high-bitcoin-beta equities like Metaplanet.

Reduced volatility

Reduced volatility might also be a potential risk as volatility makes activities surrounding the share price and instruments attractive.

Instruments like options and dynamic equity issuance rely on price movement to generate returns and attract liquidity. That said, bitcoin’s volatility, though gradually decreasing, remains structurally embedded.

On the downside, it serves as a market-cleansing force, flushing out weak hands and leverage. On the upside, fiat debasement and excess liquidity can fuel renewed surges.

As bitcoin continues its monetization phase, this volatility cycle is likely to persist, supporting Metaplanet’s business model for the foreseeable future.

New Entrants and Copycats

Other companies could emerge, mimicking Metaplanet’s bitcoin treasury model. But imitation could also legitimize the strategy and bring greater visibility. Metaplanet would likely benefit from the growing ecosystem, especially with its early-mover advantage.

As bitcoin’s price rises, it becomes more expensive to accumulate significant amounts. This gives early movers like Metaplanet and Strategy a potential long-term advantage. Their compounding treasury growth will be difficult for later entrants to match.

If they maintain and grow their treasuries, they could become the blue chips of the bitcoin treasury space.

Taxation Policy

If Japan were to lower bitcoin taxation, from the current rate of up to 55% down to 20% or less, it would likely expand retail adoption of bitcoin rather than hurt Metaplanet’s stock.

A more favorable tax regime could enlarge the entire addressable market for bitcoin and drive broader interest in bitcoin-centric equities. Far from being a threat, such a change could support Metaplanet’s long-term growth.

PFIC Classification for U.S. Investors

Metaplanet is reviewing whether it qualifies as a PFIC (Passive Foreign Investment Company), a U.S. tax classification that can trigger higher taxes, interest charges, and complex annual reporting, especially on unrealized gains, for American shareholders.

Early analysis suggests this is unlikely, as most of Metaplanet’s income is considered active, coming from bitcoin options trading and hotel operations.

The company is said to be working closely with legal and tax advisors and will provide formal guidance to U.S. investors soon.

Bear Markets Risk

Real estate cycles are inherently unpredictable. They are vulnerable to external shocks. Natural disasters, human variables, central bank policies, interest rate hikes, and shifting regulations. Paradoxically, Bitcoin offers more predictability.

It avoids many of the uncertainties tied to physical assets: no risk of structural damage, location constraints, or sudden local policy changes.

Bitcoin’s volatility, while real, is transparent and can be modeled in cycles, unlike geopolitical events, natural disasters, or shifts in interest rates, which are mostly unpredictable and harder to quantify.

The only real constraint on the long-term viability of this model, the speculative attack on fiat, is bitcoin’s short-term price volatility. Companies or investors who take on excessive leverage to accumulate bitcoin may face liquidation in sharp downturns.

At the time of writing, Metaplanet has a debt ratio of just 1% relative to its bitcoin holdings, as it currently raises capital primarily through equity issuance.

If the company continues to manage its balance sheet prudently, keeping its debt ratio below 20%, it could weather even an 80% decline in bitcoin’s price. In such a scenario, a bear market becomes a strategic opportunity rather than an existential threat.

While raising capital is harder during downturns, since a falling bitcoin price also drags down the share price and compresses the market-to-net-asset value (mNAV), potentially even below 1, those prepared with liquidity and foresight can use these periods to accumulate bitcoin at highly favorable valuations.

That’s why strategic foresight and shareholder trust are so critical. If bitcoin enters a prolonged downturn, traditional tools, like EVO-facilitated capital raises, short-duration bonds, or selling puts, may no longer be effective or prudent.

Market-to-NAV ratios could fall below 1, tempting some to call for buybacks or even bitcoin liquidation, moves that might appear accretive on paper but risk undermining long-term trust and mission clarity.

Weaker imitators could capitulate, adding sell pressure to the market. But for a disciplined operator with liquidity reserves, a strong investor base, and a clear mandate, downturns become not just survivable, they can become strategic windows.

In fact, should Metaplanet build sufficient cash buffers at cycle tops, it could even acquire distressed BTC treasuries trading at steep NAV discounts, compounding its bitcoin per share through opportunistic M&A.

Ultimately, execution and alignment, not just with price action and volume, but with conviction, will determine who survives the cycles and who leads them.

Conclusion

Bitcoin has redefined the time value of money: unlike fiat debt, where inflation and default risk increase over time, bitcoin’s risk declines if held securely, while its value grows alongside global productivity. As bitcoin appreciates, so does the creditworthiness of those who anchor their treasury strategy to it.

Metaplanet has recognized a structural gap: Japan has demand for yield and bitcoin as a solution, but lacks trust and access. By securitizing bitcoin and issuing bitcoin-backed equity, Metaplanet is tapping into pools of capital that likely wouldn’t have flowed into Bitcoin otherwise.

In doing so, it has the opportunity to help restore trust in Bitcoin within a country that remains both yield-starved and wary of Bitcoin due to the legacy of the Mt. Gox collapse.

This may prove to be one of Metaplanet’s greatest achievements: rebuilding confidence in Bitcoin in one of the world’s largest and most influential capital markets.

As bitcoin continues to monetize, individuals, corporations, even sovereigns, will increasingly borrow fiat to acquire bitcoin. What’s optional today becomes essential tomorrow. Central banks and large fiat institutions will eventually be compelled to hold it.

Fiat-based monetary systems have created a perverse incentive: asset allocators, large institutions, and even central banks are effectively short fiat, compelled to chase increasingly scarce stores of value. Bitcoin becomes the inevitable destination for capital fleeing fiat inflation.

This shift isn’t just for giants like Strategy. Smaller-cap companies can leverage the early phase of a bitcoin treasury strategy for faster bitcoin-per-share growth and mNAV expansion. Starting small enables strategic advantages: fewer shares needed to raise capital, less dilution, and stronger founder ownership. Even initial capital can be used to acquire bitcoin upfront to avoid later dilution.

This model represents the first true innovation in corporate finance in decades. Traditional frameworks continue to prioritize fiat cash flows, overlooking the deeper consequences of monetary expansion.

But in a world of relentless fiat dilution, it’s treasury composition, not cash flow, that drives long-term value.

The Bitcoin treasury model shifts corporate focus away from traditional discounted cash flow instruments like government and corporate bonds, and toward bitcoin-backed, asset-secured credit.

In an era defined by inflation and unreliable cash flows, bitcoin’s absolute scarcity offers a more dependable financial anchor.

This shift opens the door to bitcoin-denominated fixed-income and credit markets, particularly in Japan, where yield demand, global capital access, and ultra-low rates intersect.

Metaplanet’s valuation will mirror bitcoin’s volatility, but that volatility is also its engine for growth, fueling attention, narrative, and financial arbitrage, while creating emotional momentum that serves as a powerful marketing force.

In the Bitcoin era, the most powerful message a company can send is this: our balance sheet speaks the hardest money.

WORTH TO KNOW

Podcast and publications

BTC Prague: Bitcoin Is Demonetizing Other Asset Classes | BTC Prague 2025 Panel

The panel from BTC Prague on How Bitcoin Demonetizes Other Asset Classes is now online! As Bitcoin rises as a global store of value, it's starting to pull monetary premiums away from real estate, gold, bonds, and equities. Robin Seyr led a discussion with Larry Lepard, Sam Callahan, Peter Lane and myself on how Bitcoin is reshaping portfolio strategy and forcing capital to reallocate in a new financial paradigm. WATCH

TFTC: Real Estate Expert – Why Bitcoin & MSTR Are Disrupting the $300T Property Market

I returned to TFTC to discuss the housing market correction and Bitcoin's growing role as digital real estate. We covered how Strategy’s $STRF, $STRK, and $STRD products. WATCH

Terahash.talks: Bitcoin ist ein besserer Wertspeicher als Immobilien | mit Leon Wankum (GERMAN)

In the 15th episode of the German podcast terahash.talks, I spoke with TerraHash CEO and founder Kristian Kläger about my personal journey to Bitcoin, as well as my academic background in economics and philosophy. A conversation about financial literacy, sustainable wealth strategies, and the role of Bitcoin in economic transformation. WATCH

Unter Druck Podcast: Leon Wankum – Zwischen Immobilien, Enteignung und Bitcoin (German)

In this episode with Fab & Luca, we discussed the intersection of Bitcoin and real estate, and why true sovereignty today no longer relies on physical property. WATCH

Bitcoin Hotel: Warum Bitcoin Bald Explodieren Wird! Leon Wankum über MicroStrategy (German)

With Marc, we explored the current drivers behind bitcoin's price and discussed Bitcoin treasury companies like Strategy, Metaplanet, 21Capital, and Nakamoto. WATCH

Allesbetrug: Immobilien und Bitcoin: Wie Investoren ihren Gewinn steigern können (GERMAN)

In this short interview with Dominik Schwarzer, author of Alles Betrug, at BTC Prague 2025, I discussed Bitcoin’s impact on capital markets, particularly its implications for real estate. WATCH

IDEAS OF INTEREST

Metaplanet Insights

Metaplanet Bitcoin Manifesto

An overview of Metaplanet's strategic treasury transformation and Bitcoin adoption. READ

Natalie Brunell – Metaplanet: #1 Public Stock of 2024!

CEO Simon Gerovich discusses how adopting Bitcoin could 100X the company’s value. This is Simon Gerovich's first interview. WATCH

Metaplanet's Bitcoin Corporate Strategy

Simon Gerovich and Dylan LeClair at Bitcoin Abu Dhabi discuss BTC yield, the future of corporate treasury management, and how Metaplanet is pioneering new financial instruments in Japan. WATCH

The Best Performing Stock Last Year LOVES Bitcoin

Anthony Pompliano interviews Metaplanet CEO Simon Gerovich at Bitcoin Investor Week in New York, covering the company’s Bitcoin strategy, top stock performance, and Japan’s economy. WATCH

Tim Kotzmann: Dylan LeClair, Metaplanet is Japan's Bitcoin Treasury Company

Dylan LeClair, Director of Bitcoin Strategy at Metaplanet, talks about the company's success and the future of Bitcoin in Japan. WATCH

Metaplanet and "The Bitcoin Effect": Simon Gerovich at Bitcoin for Corporations 2025 Simon Gerovich shares insights on Metaplanet’s strategy at Strategy World, one of my personal favorite talks from the conference. WATCH

Syz the Future: Metaplanet CEO Simon Gerovich – The Future of Capital is Here

Simon Gerovich discusses his Bitcoin treasury strategy and valuation metrics for Bitcoin treasury companies at Syz Capital. WATCH

BULL STANDARD: Metaplanet Madness

Metaplanet has attracted a strong retail following. Peter Duan launched a podcast on Metaplanet. CHANNEL

Adam Livingston – Inside Metaplanet’s LEGAL Bitcoin Money Printer

Adam Livingston lays out the Metaplanet Playbook. WATCH

Metaplanet 2025-2027 Bitcoin Plan

An in-depth read on Metaplanet’s roadmap for Bitcoin adoption and strategy. READ

Metaplanet Dojo 1: A Metaplanet Podcast with Climb That Ladder and Vinz

Pure signal on the future of Bitcoin in corporate strategy. WATCH

Climb That Ladder – Metaplanet Dojo Episode 2

Another insightful episode from Climb That Ladder’s and Vinz’s Metaplanet Dojo. WATCH

Metaplanet Podcast EP3 | What is the 555 Million Plan?

Interview with Shinpei Okuno, Head of IR & Capital Strategy at Metaplanet, discussing the 555 Million Plan. WATCH

Metaplanet Roundtable #2 with Climb, RyQuant, Adam Livingston & Brian Brookshire

A discussion on Metaplanet by some of the sharpest minds in the space. WATCH

Dylan LeClair – Spaces: 555 Plan

Dylan LeClair explains the 555 Bitcoin acquisition plan. LISTEN

Adam Livingston – THE METAPLANET MASTERSTROKE: HOW JAPAN'S BITCOIN WAR MACHINE JUST BROKE CAPITAL MARKETS FOREVER

A deep dive into Metaplanet’s revolutionary Bitcoin strategy in Japan. READ

Climb That Ladder – Metaplanet Dojo Episode 3

Another insightful episode from Climb That Ladder’s and Vinz’s Metaplanet Dojo. WATCH

Metaplanet Trading Hours Across Markets - Built by the Metaplanet Dojo Discord community, this tool tracks global trading hours for Metaplanet across various markets. VISIT

David Lin - Bitcoin ‘Tidal Wave’ Approaching As It Becomes World’s Reserve Asset

Simon Gerovich, President and CEO of Metaplanet, discussed how Bitcoin treasury companies like his are revolutionizing corporate finance. WATCH

If you want to support me. Feel free. You can send me some satoshi/bitcoin.

Lightning: law@getalby.com

On-chain: bc1qyc9q89wjzmvaw729tj3wsrsfhft53mjycrjxdk

Nostr PubKey

npub1v5k43t905yz6lpr4crlgq2d99e7ahsehk27eex9mz7s3rhzvmesqum8rd9

Resources

Leon Wankum – Bitcoin and Real Estate (BTC Prague 2024 Keynote) WATCH

Yahoo Finance - Metaplanet Inc. (3350.T) Performance VISIT

Metaplanet - Fiscal Year 2024 Earning Presentation READ

Metaplanet - Strategic Treasury Transformation and Bitcoin Adoption by Metaplanet READ

Dylan LeClair – Metaplanet is Japan's Bitcoin Treasury Company WATCH

charts.checkonchain.com - Bitcoin Treasury Company Days-to-Replace (90d rate) VISIT

Vivek Sen – Metaplanet Secures ¥1 Billion Loan to Buy More Bitcoin READ

Adam Livingston - HOW TO VALUE BITCOIN TREASURY STOCKS WATCH

Simon Gerovich – Metaplanet's 555 Plan READ

Coinmarketcap.com - Metaplanet Expands Bitcoin Holdings with $1.4 Million by Selling Put Options VISIT

Metaplanet – Expanding Bitcoin Holdings with $1.4 Million by Selling Put Options READ

Climb That Ladder – Metaplanet Dojo 1 WATCH

Climb That Ladder – Metaplanet Dojo 2 WATCH

Climb That Ladder – Metaplanet Dojo 3 WATCH

Climb That Ladder - Metaplanet may become the 2nd largest company in the world READ

Benjamin Mudlack (Mises Institute Germany) - Real estate wealth illusion in the fiat money bubble (Immobilien-Reichtums-Illusion in der Fiatgeld-Blase) READ

Metaplanet - Notice Regarding Change in the Largest Major Shareholder READ

Photo Credit: TOKYO NOISE

A film by KRISTIAN PETRI, JAN RÖED, JOHAN SÖDERBERG

Disclaimer: the content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Make sure you do your own research before making any investment and be aware of your own risk tolerance. If you like to build on my thoughts, feel free, but please cite me as the source. 2025 - Leon Wankum.

Editing and content creation by Clemens Haidinger.

0A79 E94F A590 C7C3 3769 3689 ACC0 14EF 663C C80B