The Strategy Playbook: Lessons for Real Estate Entrepreneurs

The Bitcoin Newsletter 29

In this 29th edition of the newsletter, I explore how Strategy (formerly MicroStrategy) has laid a blueprint for corporate bitcoin adoption.

The firm uncovered a powerful dynamic: leveraging bitcoin as the core balance sheet asset to open new avenues for adoption and reshape how companies think about their balance sheets and capital allocation. This is arguably the most important innovation in applying bitcoin to corporate finance, one that will permanently shape its adoption and set a precedent worth unpacking in detail.

The DEEP DIVE explores what Strategy has done, the reasoning behind their approach, and the risks and rewards involved.

It examines the firm’s financing mechanisms and shows how they fuel their Bitcoin Flywheel while managing downside risk. Feel free to explore the sections that interest you most if you prefer a more focused read.

I want to thank Chaitanya Jain, Treasury and Investor Relations at Strategy, and Ed Juline for their help in fact-checking this article.

Best regards,

Leon

DEEP DIVE

The Strategy Playbook: Lessons for Real Estate Entrepreneurs

SPECULATIVE ATTACK

Ten years ago, Pierre Rochard published Speculative Attack, which argued that borrowing fiat money to buy bitcoin was such a favorable trade that it would inevitably drive bitcoin’s price higher.

The rationale was that as bitcoin's adoption grew, the speculative attack would become self-reinforcing, news about Bitcoin drives demand, which increases price, leading to further adoption and speculation.

Since publication, bitcoin has appreciated over 100x, delivering an annualized return of around 158%, making it the best-performing asset over the past decade. The thesis remains stronger than ever for two key reasons:

Fiat currencies are in worse shape

Debt-to-GDP ratios have skyrocketed globally.

Governments are running massive deficits.

One-third of all U.S. dollars in circulation have been printed since 2020.

More avenues for speculative attacks have emerged

Strategy has pioneered using equity and debt markets to accelerate bitcoin accumulation.

Other publicly listed companies like Metaplanet and Semler Scientific have followed suit and also adopted a Bitcoin treasury strategy among many others, kickstarting a global trend.

Nation-states may also adopt this strategy. The fiat system creates a paradoxical reality where issuers of currency and large asset holders, such as central banks, hedge funds, and pension funds, are short fiat and have an incentive to acquire bitcoin.

This can be achieved either by printing money or leveraging debt, further accelerating bitcoin's monetization.

THE STRATEGY STORY

If you think about it, anyone who spends fiat to buy and hold bitcoin is effectively leveraged, since the fiat system is built on debt. The real question is: how far do you take it? Do you simply buy bitcoin with fiat money? Take on additional leverage?

Or go even further, adopting a corporate strategy that leverages the balance sheet to accumulate bitcoin?

By now, most finance enthusiasts, regardless if they are into Bitcoin or dislike it, are aware that a Bitcoin treasury strategy has proven highly effective for Strategy, a software intelligence company that successfully transitioned into a Bitcoin treasury company.

Analyzing how the company accesses public markets reveals the potential for maximizing Bitcoin-based returns, offering valuable insights for investors and corporations alike.

As a real estate entrepreneur, I find this case particularly fascinating because it serves as a blueprint for how real estate businesses can leverage their balance sheets to accumulate bitcoin in a similar way. But, this story isn't just of relevance for real estate entrepreneurs, it’s relevant to everyone.

Strategy has uncovered a powerful dynamic that introduces entirely new possibilities for Bitcoin adoption, reshaping the way companies approach their balance sheets and financial strategies.

This story has captivated millions, and for good reasons. Michael Saylor, Strategy’s founder and executive chairman, has pioneered bitcoin corporate treasury management, leveraging bitcoin as both a store of value and collateral.

As fiat currencies continue to devalue, Strategy’s bitcoin holdings appreciate in price, causing its balance sheet, and consequently its stock, to rise, which in turn enables rapid bitcoin accumulation.

If investors perceive Strategy’s stock as a high-growth, levered bitcoin proxy, they are willing to buy new shares at a premium or invest in zero-coupon convertible bonds, which offer the option to convert into common equity at a premium, effectively allowing Strategy to raise capital at little to no interest cost.

They are able to do this because many institutional investors, due to regulatory constraints, cannot hold bitcoin directly, while others view bitcoin’s volatility as a risk to long-term performance and instead prefer short- to mid-term exposure to the upside without owning the asset outright.

In addition, some traders only want exposure to the short term volatility of financial products such as convertible bonds of Strategy, which have become popular tools for trading this volatility.

Convertible arbitrageurs and hedge funds are attracted to issuers with volatile stocks, since they can buy these bonds and engage in trading. Meanwhile, long-only investors with mandates to invest in fixed income securities, who are unable to purchase spot bitcoin, find preferred stocks an appealing way to gain exposure.

Bitcoin’s volatility functions as a driving force, significantly impacting Strategy’s stock performance, equity, and stock offerings. By consistently increasing bitcoin reserves, Strategy can capitalize on bitcoin’s long-term appreciation while enhancing resilience.

Since 2020, Strategy has strategically deployed a variety of financing mechanisms to expand its bitcoin holdings. I will outline these in detail shortly. First, I’d like to outline the rationale behind this approach.

By continuously issuing debt and equity offerings to buy bitcoin, Strategy creates a financial flywheel. As bitcoin appreciates in price, its stock price rises, enabling the company to raise capital on even more favorable terms.

This self-reinforcing cycle allows the company to expand its bitcoin holdings far more rapidly than conventional asset accumulation methods.

With Strategy shares trading at, for example, 200% above net asset value (= its bitcoin stack), Strategy can issue and sell shares representing ownership of 1 bitcoin to acquire 3 new bitcoin. The net gain, 2 additional bitcoin, becomes the Bitcoin Gain, effectively increasing the bitcoin holdings per share for existing shareholders.

Strategy has engineered a self-reinforcing capital engine, a Bitcoin treasury flywheel. It does this by leveraging an elevated market value of its equity relative to its bitcoin holdings (mNAV).

This metric is conceptually similar to the price-to-earnings (P/E) ratio in traditional finance, which gives insight into a company’s valuation relative to its earnings.

For a Bitcoin company, using the ratio of market value to bitcoin treasury makes sense, as the size and value of its bitcoin holdings are the underlying metric that drives both performance and investor perception.

When mNAV is high, the company can issue new shares at a premium and use the proceeds to acquire more bitcoin, compounding its treasury over time. This increases its bitcoin-per-share metric (BTC yield).

For example, with a 3x mNAV, even a modest dilution can result in a 3–7x stock move, without any change in bitcoin's price.

The company is effectively acquiring more bitcoin per share than it is issuing, amplifying bitcoin exposure per fully diluted shares. Investors value that leverage.

By increasing the BTC yield, Strategy has transformed its Bitcoin treasury into a business model, capitalizing on early-stage adoption and investor demand for regulated exposure.

The spread Strategy exploits is not just the difference between its stock price and its bitcoin holdings, but also the arbitrage opportunity between traditional capital markets, where borrowing costs are low, and bitcoin’s historically higher returns.

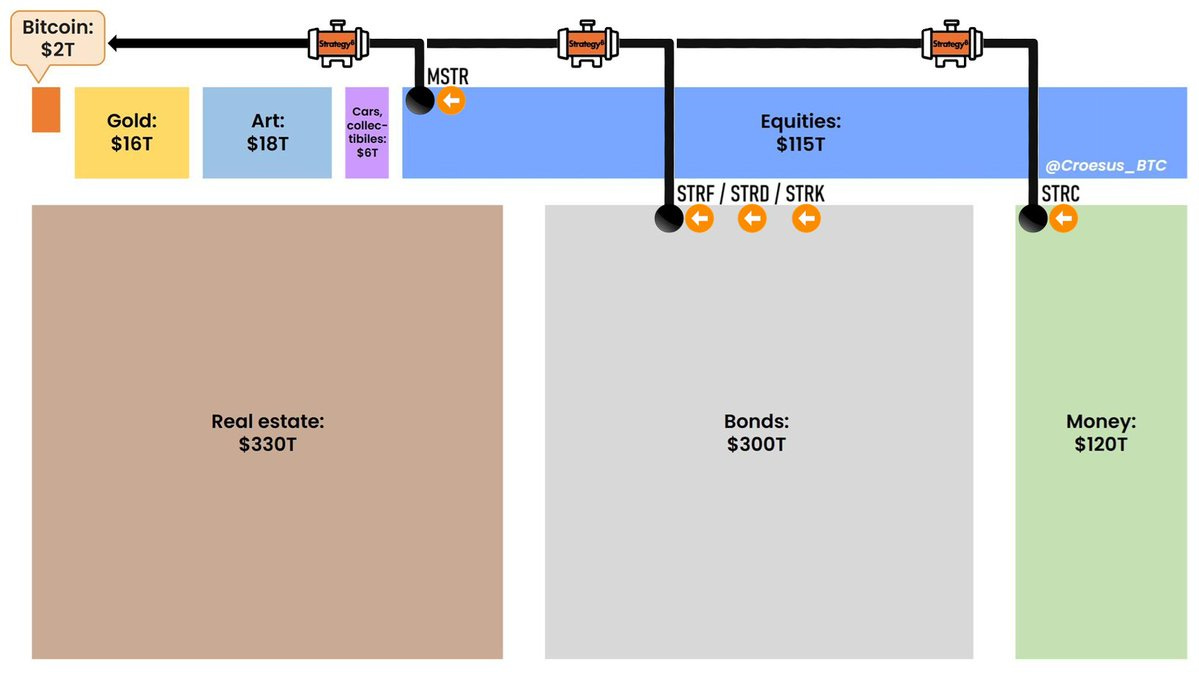

In the picture below, you’ll see the Bitcoin Treasury Model of Strategy, which evolves into a self-reinforcing Bitcoin Flywheel for Success.

It all began with the conversion of cash reserves into bitcoin, when the company was still known as MicroStrategy. It announced its initial purchase of 21,454 bitcoin for approximately $250 million in August 2020, citing bitcoin’s potential as a reliable store of value and an attractive investment asset.

As Strategy converted its excess cash into bitcoin, it became the company’s primary treasury asset. As bitcoin appreciates, Strategy’s balance sheet strengthens, attracting greater investor interest in its equity and debt offerings. This enables the company to raise capital on more favorable terms for further bitcoin acquisitions.

The growing bitcoin holdings amplify stock volatility, a reflection of bitcoin's volatility, which appeals to traders and drives higher trading activity and further investor enthusiasm.

This, in turn, allows Strategy to secure more capital for additional bitcoin purchases, reinforcing a self-sustaining flywheel that continuously expands its bitcoin treasury.

In the following, I will provide a detailed explanation of Strategy’s financing mechanisms, demonstrating how they drive the Bitcoin Flywheel while effectively managing downside risks. I will also cover the financial instruments Strategy employs, when, how, and why.

As of August 14th, 2025, Strategy holds nearly 700,000 bitcoin, representing over 3% of the total supply, and growing. To finance these acquisitions, the firm has issued $8.21 billion in convertible debt at an exceptionally low average interest rate of 0.421%, resulting in an annual interest obligation of just $34.6 million.

Over time, however, the company has also developed less dilutive financing strategies, such as issuing bitcoin-backed fixed income as preferred stock.

These instruments allow Strategy to acquire bitcoin with debt capital while minimizing shareholder dilution across different market cycles, I will examine the Bitcoin Flywheel in greater detail in this article. These figures are subject to change and are current as of August 14th, 2025 (strategy.com, 2025).

Meanwhile, Strategy maintains a strong cash flow position, generating approximately $464 million in annual revenue from its core software business in 2024, bolstered by subscription growth and increased brand recognition.

Despite a 3% year-over-year decline in overall revenue in Q4 2024, subscription services saw a 48% year-over-year increase in the same period, strengthening the company’s ability to service its obligations while expanding its bitcoin holdings (Strategy, 2025).

Strategy has structured its balance sheet for maximum bitcoin accumulation with relatively low debt and minimal dilution, all while maintaining extraordinary treasury growth.

To put this into perspective, real estate investments are typically acquired with much higher leverage. For example, an investor can purchase a $1 million property with just 20% equity ($200,000) and $800,000 in bank financing, resulting in a debt ratio of 80%.

In contrast, as of August 14, 2025, Strategy holds approximately $8 billion in convertible debt against a $110 billion market capitalization and $76 billion in bitcoin, representing a debt burden of about 7% relative to its market capitalization, or 10.5% when measured against its bitcoin reserves, both significantly lower than the traditional debt ratios seen in real estate. These figures vary depending on the day and are updated in real time on the official Strategy tracker: strategy.com.

Additionally, bitcoin’s market value has grown at a compound annual growth rate of over 50% over the past 10 years, outpacing residential and commercial real estate by far, which have grown at average compound annual growth rates of approximately 5.6% and 4.4%, respectively, since 1971 (St. Louis FED, 2025).

This rapid appreciation means that bitcoin can quickly outpace the debt used to finance its purchase, faster than the debt typically incurred in real estate investments, underscoring its superior potential as a store of value.

This comparison is highly appropriate, as the price appreciation dynamics of real estate and bitcoin are similar. Both are scarce assets that increase in value with fiat inflation.

But, in contrast to real estate, which is relatively scarce but continuously developed and expanded, bitcoin is absolutely scarce, with a fixed supply cap of 21 million. This supply constraint drives its value appreciation at a significantly faster rate than real estate.

Strategy’s treasury of almost 700,000 bitcoin provides a fundamentally different foundation for financial security, one that keeps growing over time. The larger the treasury becomes, the more secure the company’s position is as a debtor, and the greater its capacity to acquire even more bitcoin.

This creates a powerful positive feedback loop that not only ensures greater stability for employees, but also enables operational expansion and strengthens brand recognition (Strategy, 2025).

I will delve into the financial instruments that Strategy utilizes and deploys shortly. Beforehand, I will explain why Strategy avoids taking on excessive risk.

Strategy's bitcoin treasury strategy reflects a balanced approach to corporate finance, underpinned by its relatively conservative debt-to-asset ratio. This positions the company to effectively manage debt while continuing to grow its bitcoin holdings.

As of August 14, the company’s bitcoin were valued at approximately $76 billion, with its net asset bitcoin value premium at 1.6× compared to its basic share price. In other words, the company was trading at just 1.6 times the value of its bitcoin holdings.

Again, these figures vary depending on the day and are updated in real time on the official Strategy tracker: strategy.com.

Bitcoin, being absolutely scarce, is becoming a new unit of account, redefining how we measure financial success. In this framework, the financial strength of a Bitcoin company can be better assessed by its bitcoin holdings relative to its market value, rather than traditional earnings metrics.

While P/E ratios are common in valuing traditional tech companies, they’re less relevant when it comes to a company like Strategy, where the value of the company is tied directly to its bitcoin holdings. Here, the ratio of bitcoin holdings to company valuation serves as a more appropriate benchmark for performance. By focusing on maximizing Bitcoin Yield, Strategy has entered what can be called its Golden Age.

Yield here refers to the change in the ratio between bitcoin holdings and the company’s diluted shares.

In addition to the phenomenal income generated through the appreciation of its bitcoin holdings, Strategy’s robust cash flow, producing annual revenue of around $460 million against interest obligations of roughly $35 million, ensures it can comfortably service its debt while avoiding overexposure to risk.

Although this does carry risk, it represents a well-considered approach rather than reckless risk-taking. The strategy also offers flexibility to manage future refinancing, even if interest rates rise significantly.

I will now outline Strategy’s financing mechanisms, explaining how they drive the Bitcoin Flywheel while managing downside risks. Afterwards, I will address how the flywheel could come to a halt, the criticisms of the Bitcoin Treasury Model and identify which companies are best suited for adopting this strategy.

I’ll cover the instruments Strategy uses in chronological order, culminating in a detailed examination of its preferred shares. Particular emphasis will be placed on bitcoin-backed securities, because they are the core fuel driving the flywheel toward escape velocity.

I’ll examine rewards, risks, downside protection, and investor participation. If the level of detail on these financial instruments feels too in-depth, you can skip ahead to the potential endgame of the flywheel, before I address the risks and the types of companies best suited for a Bitcoin treasury strategy.

STRATEGY’S FINANCING MECHANISMS:

FUELING THE Bitcoin Flywheel WHILE MANAGING DOWNSIDE RISKS

1. Free Cash Flows to Buy Bitcoin

What it does:

Instead of holding excess cash reserves in fiat, Strategy allocates free cash flow from its operations to purchase bitcoin.

Example:

When the company was still known as MicroStrategy, it announced its initial purchase of 21,454 bitcoin for approximately $250 million in August 2020, citing bitcoin's potential as a reliable store of value and an attractive investment asset.

Rewards:

For Strategy: Avoids fiat devaluation and builds long-term wealth in bitcoin.

For Investors: It enhances long-term shareholder value by accumulating an appreciating asset rather than holding cash in an inflationary fiat currency.

Risks:

If bitcoin’s price drops, the company may temporarily see lower net asset values.

Less fiat liquidity for operational expenses if needed.

Downside Protection:

For Strategy: It retains operational cash reserves outside of bitcoin to cover short-term expenses.

For Investors:

Strategy maintains a diversified revenue stream from its software business, reducing reliance on bitcoin’s fiat value alone. Strategy’s Bitcoin strategy has elevated its public profile, attracting more customers to its core software business, creating a virtuous cycle of brand visibility and revenue diversification.

Why Investors Participate:

Investors see this as a long-term value play, similar to companies that reinvest profits into high-growth assets. By holding bitcoin, Strategy’s balance sheet is effectively inflation-resistant, making it an attractive investment compared to cash-heavy companies exposed to currency debasement.

How it fuels the Bitcoin Flywheel:

By converting cash into bitcoin, Strategy reinforces the speculative attack on fiat, steadily replacing traditional reserves with a superior store of value.

2. Equity Issuance (Selling New Shares at a Premium)

What it does:

Strategy issues new stock when its share price is high, using the proceeds to buy more bitcoin. With Strategy shares trading at, for example, 200% above net asset value, Strategy can issue and sell shares representing ownership of 1 bitcoin to acquire 3 new bitcoin.

The net gain, 2 additional bitcoin, becomes the “Bitcoin Gain”. While this dilutes shareholders, it increases the company’s bitcoin exposure per share.

For Strategy the value of the bitcoin held in relation to the company’s market capitalization is essential for capital raising, allowing the company to expand their bitcoin holdings while enhancing creditworthiness and increasing investor demand for the stock and its core business.

Strategy has made clear in its guidance that it will not issue common stock at market prices below 2.5× its net bitcoin holdings, except in one specific case: to fund distributions on its bitcoin-backed preferred shares. This disciplined approach preserves bitcoin-per-share for existing shareholders, avoiding unnecessary dilution.

The preferred share program, as I will explain shortly, allows Strategy to raise capital at yields far below bitcoin’s historical growth rate, making it a more efficient funding tool than equity issuance under most conditions.

Example:

Between 2021 and 2025, Strategy raised over $22 billion through at-the-market (ATM) equity offerings, selling stock at elevated prices to fund bitcoin purchases.

Rewards:

For Strategy: Raises capital at a premium, reducing dilution while accumulating bitcoin.

For Investors: Indirect, levered exposure to bitcoin, which many institutions prefer due to regulatory or custodial restrictions.

Risks:

If bitcoin’s price drops, the stock may decline, limiting demand for capital raises.

Issuing too many shares pushes down the price, eliminating the premium that could otherwise be arbitraged into buying more bitcoin.

Market sentiment can affect demand for new shares.

Downside Protection:

For Strategy: Only issues new stock at elevated market valuations to minimize dilution. Recently, it announced guidance stating that it will not dilute the common stock unless its market valuation is at least 2.5 times the value of its bitcoin treasury (net asset value).

For Investors: Investors participate at a premium price, meaning they are already accounting for bitcoin’s volatility and future upside in valuation.

Why Investors Participate:

For investors who can’t directly hold bitcoin, owning Strategy’s stock is the next best thing. It functions as a high-beta bitcoin proxy, meaning it moves more aggressively than bitcoin itself. With a 1.5x factor on both the upside and downside.

How it fuels the Bitcoin Flywheel:

As bitcoin’s price increases, Strategy’s stock appreciates. The company then issues new shares at a premium, buys more bitcoin, and repeats the cycle.

3. Bonds & Traditional Debt

What it does:

Strategy raised capital by issuing traditional bonds and debt from institutional investors. These instruments provide predictable returns while shielding investors from the volatility of the common stock, all while enabling Strategy to accumulate bitcoin at large scale.

Example:

In June 2021, Strategy issued a $500 million secured note at 6.125% interest due in 2028. The proceeds were used entirely to purchase bitcoin, further strengthening its reserves.

Rewards:

For Strategy: Access to large amounts of capital without immediate shareholder dilution.

For Investors: Stable, predictable returns backed by the company’s balance sheet.

Risks:

Higher leverage increases financial risk and potential refinancing challenges.

Debt holders are typically not interested in the long-term prospects of a company.

To hedge their downside, they often short the common stock against the debt they own, which can create persistent selling pressure on the stock.

Downside Protection:

For Strategy: The debt is reportedly unsecured by bitcoin, reducing the chance of forced bitcoin liquidation by creditors. This, in turn, is a strategic advantage for the company, as it avoids concentrating risk on its core asset.

For Investors: The company’s financial health is anchored by it’s substantial bitcoin reserves and its core software intelligence business, significantly reducing default risk. As bitcoin continues to monetize amid persistent fiat inflation, this backing becomes increasingly valuable. It is not based on future cash flows, but on an appreciating asset that Strategy already holds: bitcoin.

Why Investors Participate:

Traditional bond and debt investors, such as pension funds and insurance companies, seek predictable yields with strong collateral. Since Strategy’s bitcoin holdings appreciate over time, the company's financial position strengthens, making its debt attractive to investors. Backed by its core software intelligence business, which does generate cash flow.

How it fuels the Bitcoin Flywheel:

By using fiat-denominated debt to acquire bitcoin, Strategy accelerated accumulation. As bitcoin appreciates, its balance sheet strengthens, making it easier to raise more capital.

4. Convertible Notes/Bonds

What it does:

Strategy issues convertible bonds with 0% interest and a high conversion premium, allowing bondholders to convert into stock if the price rises.

Strategy capitalizes on the potential conversion of its convertible debt at a premium, allowing it to raise capital at effectively 0% interest. The company’s convertible debt is structured to convert over four to seven years.

Even when accounting for potential dilution from Strategy’s debt against a growing Bitcoin treasury, the impact on shareholders is relatively minor.

This is because the capital raised is used to acquire bitcoin, which, on average, increases in purchasing power by over 50% annually. Since the convertible notes mature over four to seven years, the appreciating value of Strategy’s Bitcoin treasury allows the company to accumulate more bitcoin in the meantime, further strengthening its balance sheet.

Example:

In November 2024, Strategy issued $3 billion in zero-coupon convertible senior notes due in 2029. The conversion price was set 55% above the stock’s market price, meaning that if the stock rose well above this level, bondholders could convert into equity at a price below the prevailing market rate.

Rewards:

For Strategy: Enables immediate bitcoin acquisition by raising capital at 0% interest, with the option to convert into stock at a premium in the future, reducing financial burden.

For Investors: If Strategy’s stock appreciates above the preset conversion price, bondholders can convert their debt into equity at favorable terms, making the instrument potentially highly lucrative.

Risks:

For Strategy: If Strategy’s stock does not rise above the conversion price, bondholders may not convert, potentially leaving the company with debt to repay.

For Strategy: The holder repurchase option date is a predetermined milestone that grants bondholders the right to require Strategy to repurchase their bonds at a set price, typically around 3.5 years after issuance, plus accrued and unpaid special and additional interest, if any.

In Strategy’s case, this risk is mitigated by its Bitcoin-based strategy, as Bitcoin has historically appreciated significantly in purchasing power over time, increasing the likelihood that the convertible notes will be in the money and converted into common equity instead of being repurchased.

For Strategy: Convertible bond traders are typically not interested in the long-term prospects of a company, but in profiting from bond price movements.

To hedge their downside, they often short the common stock against the convertible bonds they buy, which can create persistent selling pressure on the stock.

Downside Protection:

For Strategy: The conversion rates are set with a four- to seven-year outlook. By that time, bitcoin will likely have completed a halving cycle, typically occurring every four years, resulting in a substantial price appreciation.

For Strategy: The company must retain the flexibility to settle conversions using cash, Class A common stock, or a combination of both. This requires Strategy to maintain sufficient creditworthiness, supported by a growing Bitcoin treasury and consistent revenues from its core software intelligence business and a growing, to meet potential repurchase and conversion obligations.

For Strategy: Even if bondholders don’t convert, the debt remains zero-coupon, meaning no cash interest payments are due.

For Strategy: The debt is unsecured by bitcoin, reducing the risk of forced liquidation and protecting its core asset.

For Investors: If the stock price fails to rise, bondholders still hold a senior debt claim, ensuring they receive principal repayment.

For Investors: Strategy’s balance sheet is backed by bitcoin rather than uncertain future cash flows, minimizing default risk and reducing it over time as bitcoin appreciates.

Why Investors Participate:

Convertible bonds offer a low-risk entry point to bitcoin exposure, as investors can participate in upside potential while maintaining downside protection.

This structure attracts legacy institutions such as Allianz, a German insurance giant, known for its conservative approach to deploying capital, which acquired nearly 25% of one of Strategy’s convertible issuance in November 2024.

How it fuels the Bitcoin Flywheel:

Zero-interest capital allows Strategy to buy bitcoin with no financing cost, ensuring its balance sheet remains leveraged towards bitcoin appreciation, with minimal risk.

While effective, convertible bonds have limitations. Traders in this market are typically not aligned with a company’s long-term vision, they’re simply looking to profit. To hedge their downside, they often short the stock of the company whose bonds they hold, creating persistent selling pressure.

Today, Strategy has shifted to fixed-income securities, allowing it to raise capital without diluting shareholders or putting pressure on the stock.

A key advantage I’ll explore further in the next section.

5. Preferred Stock

What it does:

Strategy issues preferred stock that pays fixed dividends, offering investors bitcoin exposure with reduced volatility compared to the common stock. As of the time of writing, the Strategy team has already introduced four such instruments.

All instruments have a par value of $100, which represents the amount investors would be entitled to in the event of a bankruptcy. In the following, I will briefly outline these instruments.

Example:

$STRK: On March 10th, Michael Saylor unveiled an initiative to acquire bitcoin through $STRK, a first-of-its-kind bitcoin-backed preferred stock designed to attract investors seeking exposure to bitcoin’s upside without common stock volatility.

$STRK offers an 8% annual dividend, has a perpetual duration, and provides unlimited upside potential. $STRK shares are also convertible by holders into Class A common stock at a 10:1 ratio, meaning each $STRK share converts into 0.1 shares of common stock once the MSTR common stock price reaches or exceeds $1,000. STRK offers a blend of income and potential equity growth through its conversion feature.

Summary:

Target Clients: Bitcoin bulls, hybrid income+growth investors, family offices.

Investment Motivation: 8% annual income plus upside.

Upside: Convertible into MSTR at a 10:1 ratio (0.1 share per STRK) once MSTR ≥ $1,000.

Security for Investors: Cumulative dividends and overcollateralized with BTC; preferred payment rank.

What It Solves: Provides fixed yield plus optional equity upside. An investment-grade bond with real estate–like upside.

Compared to:

Real estate: Less illiquid, higher yield, added conversion upside.

High-yield bonds: Riskier, no bitcoin backing.

Common stock: Too volatile, no fixed income.

Investor Benefit: Income + BTC-equity upside without dilution.

$STRF: On March 20th, 2025, Strategy priced 8.5 million shares of $STRF (Series A Perpetual Preferred Stock) at $85 each, with a 10% annual cumulative dividend, meaning any missed payments accrue and must be paid.

Aimed at tapping into the $300T+ bond market by providing a bond-like vehicle with bitcoin exposure. At the same time, the move is a direct challenge to real estate returns, as I will explain shortly.

It’s unlikely Strategy would ever need to sell bitcoin to cover any of these instruments, as they are overcollateralized by 5–8x. STRF and STRK, designed to mimic investment-grade fixed income, are prioritized to maintain that low-risk profile, even without formal credit ratings.

Instead, they carry a BTC Rating, a proprietary measure developed by Michael Saylor and Strategy to assess the safety and efficiency of bitcoin-backed instruments.

The BTC Rating measures the ratio of bitcoin backing a security relative to the amount owed. For example, $1 billion in BTC collateral against $100 million in liabilities yields a 10:1 cushion. The higher the rating, the greater the over-collateralization and the lower the risk.

Summary:

Target Clients: Fixed-income allocators, bond-focused investors, conservative HNWIs, pensions, insurers.

Investment Motivation: 10% stable annual income with prioritized payment.

Upside: No equity conversion; designed for reliability, not growth.

Security for Investors: Cumulative dividends; highest liquidation preference among Strategy’s preferreds. Overcollateralized 5–8x with BTC.

What It Solves: Delivers reliable yield backed by bitcoin to income-focused capital with limited risk appetite. Like a sovereign bond, but better.

Compared to:

Sovereign bonds: Lower yield (2–4%), inflation risk.

Corporate bonds: Lower returns, higher default risk.

Real estate: Less liquid, operational friction.

Investor Benefit: Long-term, stable cash flows with superior collateral.

$STRD: The third instrument, $STRD, was announced on July 7th, 2025, as part of a $4.2 billion at-the-market issuance program. Like STRF, it offers a 10% dividend, but unlike STRF, it is non-cumulative, meaning missed payments don’t accrue. This gives Strategy greater flexibility during downturns or periods of financial stress.

STRD is also positioned as a liquidity management tool: a way to raise capital quickly without taking on debt, and potentially use proceeds for opportunistic stock buybacks or other corporate purposes. If the company’s debt ratio exceeds 30%, STRD can be used to raise capital specifically to buy back common stock.

Historically, most preferreds have continued to pay distributions, even during the 2008 financial crisis, but in a crisis scenario, it is unlikely Strategy would sell bitcoin to cover STRD payments, unlike with STRF or STRK.

Summary:

Target Clients: Opportunistic investors, flexible treasuries, yield-focused allocators with higher risk tolerance.

Investment Motivation: 10% annual income with issuer flexibility.

Upside: Higher coupon, tactical use of proceeds (e.g., buybacks).

Security for Investors: Non-cumulative dividends; lower liquidation rank than STRF/STRK but still overcollateralized with BTC.

What It Solves: Enables Strategy to raise capital in volatile conditions without fixed payout obligations. Technically structured like a junk bond, but practically overcollateralized by the most pristine asset in the world, bitcoin.

Compared to:

Junk bonds: Similar yields, far inferior collateral.

Private debt: Illiquid, lower transparency.

Corporate debt: Rigid structures, weaker balance sheets.

Investor Benefit: High yield with a flexible structure.

$STRC: Launched on July 21st, 2025, STRC became the largest preferred stock IPO of the decade, raising $2.46 billion net of fees. STRC functions like a high-yield savings account, offering steady returns with full liquidity. It operates similarly to a bitcoin-backed stablecoin, where investors receive the $100 they put in, plus a fixed 9% annual yield.

STRC is designed for all types of savers, from high-net-worth individuals to everyday investors, seeking stable income with the flexibility of redemption. It is particularly attractive to those looking for fixed returns without committing capital over the long term.

It appeals to short-duration, yield-seeking investors looking for a less volatile alternative to money market funds, stablecoins, or short-term debt instruments, targeting capital starved for yield in a post 4% money market environment.

It serves as a bridge for fiat capital migrating from traditional credit and fixed income markets into the Bitcoin ecosystem.

Summary:

Target Clients: Savers, short-duration fixed-income investors, cash-optimizers — HNWIs to retail.

Investment Motivation: 9% yield with monthly liquidity and capital protection.

Upside: None. Focused on fixed income and flexibility.

Security for Investors: Monthly redemption at $100 par; fully backed by Strategy’s BTC treasury (1–5x overcollateralized).

What It Solves: Provides liquidity and yield in a bitcoin-native vehicle that mimics money market characteristics. Like a savings account, but better.

Compared to:

Money market funds: Lower yield (1–4%), fiat risk.

Real estate: Illiquid, maintenance burden.

Government bonds: Duration risk, lower income.

Investor Benefit: Fixed 9% income with full liquidity

What began as a $21 billion initiative has grown into a $42 billion fixed-income program.

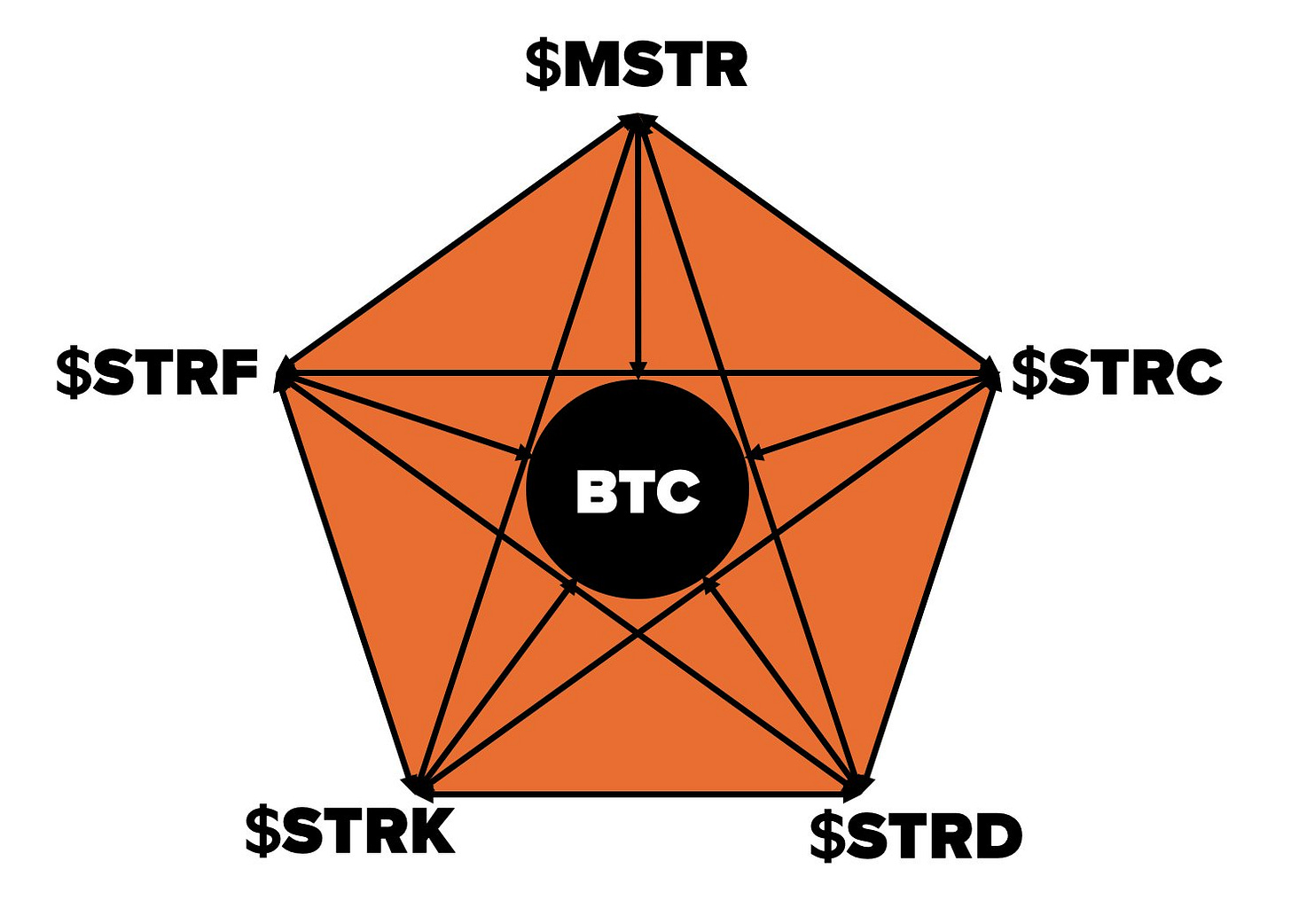

Strategy’s preferred stock offerings, STRK, STRF, STRD, and STRC, form a bitcoin-native capital stack bridging traditional finance with a new monetary standard.

These products deliver 8–10% annual yields, outperforming the 3–6% returns typical in real estate, without tenants or maintenance, or immobility. STRK includes a conversion feature for upside, while STRC offers 9% yield with monthly redemption at $100 par value.

The offerings target both the $300 trillion bond market and the $300–400 trillion real estate market. Michael Saylor has publicly stated his aim to capture 1% of the $300 trillion bond market. While he hasn’t quantified a real estate target, he has positioned these offerings as superior to traditional property investments.

Combined, a 1% share of each market could funnel over $6 trillion into Strategy’s bitcoin-backed fixed income products.

Property owners will know all too well the risks and hassles that come with real estate investments. Quite simply, Strategy’s preferred offerings carry none of those burdens.

STRK offers income with upside, STRF delivers steady yield, STRD provides flexibility in uncertain times, and STRC combines liquidity with fixed returns to the investor.

Together, they form a Bitcoin-native alternative to traditional financing, designed as a yield curve for varying risk appetites and macro environments.

Strategy is no longer just a software company; it’s building a new financial layer that extracts capital from legacy markets and reorients it toward bitcoin.

Rewards

For Strategy: Capital without dilution.

Strategy raises capital without giving up voting control or significantly diluting shareholders.

STRK enables streamlined fundraising and is positioned as a high-yield instrument, offering additional upside through potential equity conversion.

STRF targets conservative, yield-seeking capital with a 10% cumulative dividend. Effectively structured as investment-grade fixed income.

STRD offers non-cumulative dividends, giving Strategy more flexibility, especially useful for liquidity management during bear markets or opportunistic buybacks.

STRC delivers a 9% yield with fixed $100 par value and monthly redemption, offering both income and liquidity for capital that values optionality. Enabling fundraising across different macro environments.

For investors: Tailored income and downside protection.

STRK offers income plus upside.

STRF provides steady, cumulative income.

STRD offers flexibility for opportunistic capital.

STRC combines high yield with liquidity.

Institutionally friendly: Suitable for pensions, endowments, insurers, and savers. restricted from direct bitcoin exposure.

Downside protection: All preferreds rank above common shares in liquidation.

Risks:

For Strategy:

STRF has cumulative dividends, missed payments accrue with penalty interest.

Bitcoin price risk: All distributions on the instruments are backed by Strategy’s Bitcoin treasury. A steep price drawdown could strain payout capacity if not carefully managed. However, the risk is negligible, which I'll discuss in more detail shortly.

Adoption curve: Many institutional allocators are still unfamiliar with bitcoin-backed fixed income. Uptake may take time.

For Investors: Tailored income and downside protection.

Capital structure risk: Preferred shares rank above common stock but below unsecured debt in liquidation. But Strategy’s debt is reportedly unsecured by bitcoin, reducing the chance of forced bitcoin liquidation by creditors.

This, in turn, is a strategic advantage for the company, as it avoids risk on its core asset.

Unlike typical investment-grade credit, where you’re underwriting uncertain future cash flows, Strategy already holds the asset, bitcoin.

This dramatically reduces risk, particularly for investors who understand bitcoin’s long-term trajectory and reliability as collateral.

Downside Protection:

Strategy’s bitcoin-backed preferred offerings represent a Bitcoin-native capital structure, backed not by projected cash flows or taxes, but by a deeply overcollateralized Bitcoin treasury.

FASB accounting rules now allow unrealized bitcoin gains to be recognized as income, letting price appreciation flow directly into reported earnings.

While bitcoin experiences periodic drawdowns, its long-term performance has historically outpaced the cash flow of most companies. This structure avoids the fragility of traditional debt.

In upcycles, Strategy can issue equity; in downturns, it can refinance or rely on recurring revenues from its software intelligence business.

It’s a credit model not built on projections, but on bitcoin possession, overcollateralized, appreciating, and compounding over time.

If bitcoin accumulation continues at the current pace, Strategy could hold over 1 million bitcoin by 2029. At a conservative 20% compound annual growth rate, well below historical averages, and starting from $120,000, each bitcoin would be worth ~$248,832 by then, bringing the treasury’s value near $249 billion, a very cautious estimate given bitcoin’s historical price trajectory.

Even in a scenario where Strategy fully issues all targeted $42 billion in preferred shares, assuming a 10% distribution rate, which is on the very high end, the resulting $4.2 billion in annual obligations would amount to just 0.67% of the projected treasury value.

That’s effectively a rounding error on a balance sheet compounding toward the trillions. As bitcoin appreciates, these obligations continue to shrink in relative size, reinforcing the durability and scalability of Strategy’s capital model.

Why Investors Participate:

These bitcoin-backed, fixed-income products offer a compliant and familiar on-ramp for institutional capital, pensions, endowments, and insurers, as well as savers and high-net-worth individuals. Many of these allocators prioritize stability over upside and are mostly restricted from holding commodities like bitcoin directly.

For capital traditionally limited to bonds or real estate, Strategy’s offerings create a new way to participate in bitcoin’s monetization.

Strategy is building an entirely new capital stack around Bitcoin, attracting traditional investors, offering structured income, and avoiding common stock dilution, all while accumulating bitcoin at unprecedented scale

How it fuels the Bitcoin Flywheel:

By introducing bitcoin-backed preferreds, Strategy taps into broader investor segments, channeling traditional income demand into direct bitcoin accumulation.

This accelerates the Bitcoin Flywheel: more capital → more bitcoin bought → higher share price → more capital can be raised → more bitcoin bought → higher price → and so on.

Instead of compounding risk, like with traditional fiat leverage, Strategy’s model does the opposite: As bitcoin appreciates, the ratio of obligations to collateral shrinks rapidly, making its bitcoin accumulation strategy increasingly robust and efficient over time.

The demand for such instruments isn’t static: It can keep expanding until Bitcoin eventually surpasses the entire fixed-income sector. Capital naturally migrates toward harder money and more reliable collateral over time.

At roughly $300 trillion, the bond market is around 150 times larger than Bitcoin, leaving massive room for growth.

Each instrument is designed to enable Strategy to accumulate bitcoin during all market phases. It aims to be the leading issuer of bitcoin-backed credit, but it won’t be the last.

HOW TO DESIGN A BITCOIN NATIVE CAPITAL STACK

Strategy’s financing model revolves around maximizing bitcoin per share while minimizing dilution. To achieve this, it evaluates all capital tools by their Bitcoin Torque (BTC Torque), a metric measuring how efficiently fiat is converted into bitcoin exposure.

A torque above 1 means the capital raised creates more bitcoin value than it costs. For example, a BTC Torque of 10.4 means that every $1 raised results in $10.40 worth of bitcoin exposure on the balance sheet, more than ten times the initial capital.

Below is an example of how different capital instruments can be strategically deployed and evaluated for their effectiveness in generating BTC Torque, as illustrated with MSTR common equity, STRF, and STRK.

Equity issuance is the most dilutive method, while it increases bitcoin holdings, it reduces bitcoin per share unless shares are sold well above 1x mNAV.

Convertible bonds tend to be less dilutive than equity but can create selling pressure, as arbitrage-driven investors short the underlying stock to lock in profits and hedge downside, potentially weakening performance.

Strategy’s preferred share suite, STRK, STRF, STRD, STRC, and future issuances, now forms the backbone of its speculative attack funding model. By issuing fixed-income instruments backed by a rapidly compounding bitcoin treasury (~50% annually), Strategy can raise fiat capital efficiently. Even at 8–10% yields, the collateral’s growth far exceeds the cost of capital, making these offerings structurally advantageous.

Even if all $42 billion in preferred shares were issued, the $4.2 billion annual obligation could be sustained for centuries, because Strategy’s model isn’t based on uncertain future cash flows, taxation, or money printing, but on bitcoin: an appreciating asset already on its balance sheet.

At current prices, Strategy holds enough bitcoin to cover 180 years of preferred payouts. Even if bitcoin fell by 75%, the company would still have 26 years of coverage, highlighting the durability of this asset-backed model.

In short, preferreds offer the best balance: they preserve shareholder value, provide access to deep capital markets, and maintain Strategy’s long-term goal, acquiring more bitcoin without excessive dilution.

WHEN WILL THE FLYWHEEL COME TO A HALT?

The flywheel will come to a halt once the fiat system ends, effectively eliminating the arbitrage opportunity between low fiat interest rates and high bitcoin growth rates.

Moreover, Strategy loses its unique advantage once bitcoin is fully monetized, potentially becoming the primary store of value, and investors hold it by default, which would eliminate the need for exposure via regulated fiat-based financial vehicles. However, by then, Strategy should have acquired enough bitcoin to capitalize on its holdings.

This is because we can assume, based on the Lindy Effect, which states that things that have lasted a long time will continue to endure, that the fiat system still has several decades ahead of it.

This allows Strategy to capitalize on the arbitrage between its bitcoin holdings and its market value during periods when bitcoin’s price is rising for the foreseeable future.

Afterwards, Strategy simply either benefits from bitcoin’s price increases driven by rising productivity or by transforming into a bank-like institution that leverages its bitcoin holdings through lending, providing liquidity to the Lightning Network, or other financial activities.

CRITICISM AND RISKS OF STRATEGY’S BITCOIN TREASURY MODEL

Many fear that Saylor or Strategy, with their large bitcoin holdings, could exert influence over Bitcoin. Although Saylor certainly has influence over people, because he is a celebrity, he cannot alter the Bitcoin Core software.

The blocksize wars of 2017 demonstrated that the network operates in a decentralized manner, relying on node runners rather than influential Bitcoin businesses or hodlers.

While it is true that a prominent figure like Michael Saylor can attract attention and bring more capital into the market, Bitcoin’s value proposition does not rest on a single spokesperson.

Instead, it flows from fundamental properties such as a predictable issuance schedule, global accessibility, cryptographic security, and a robust community of decentralized node operators.

Large-scale accumulation or aggressive “pumping” cannot override the network’s neutral treatment of all transactions or inflate bitcoin’s supply beyond the consensus rules (Rochard, 2025).

Furthermore, since the flywheel will eventually come to an end, Strategy’s approach does not lead to a complete centralization of bitcoin holdings.

It may seem that way because, as a pioneer, Strategy took advantage of the opportunity to invest inexpensive fiat loans into bitcoin on a large scale early on. However, over time, more companies will follow suit. Because Michael Saylor took the risk early, he will be rewarded, that's simply how the market works.

A potential risk is dilution from repaying debt if convertibles do not convert into equity, especially if capital must be raised under unfavorable terms. In 2021, even with a strong balance sheet, lenders demanded over 6% interest on Strategy’s bonds.

In a worst-case scenario, the company might need to sell bitcoin to meet obligations. But, this is highly unlikely, as Strategy has structured its convertibles to convert with long maturities, aligning stock appreciation with bitcoin’s rise.

Furthermore, with $464 million in annual revenue, the company generates enough cash flow to service its obligations and finance its debt repayments.

Concerns about fiat debt creation are valid, as borrowing can fuel inflation. However, these dynamics are inherent in modern business, and how much one engages with them is ultimately a matter of choice.

While Strategy can only capitalize on the premium between its bitcoin holdings and market value when shares trade above net asset value, bitcoin’s appreciation over time mitigates concerns about short-term entry points. In the long run, the purchase price of bitcoin becomes less relevant.

Strategy’s bond issuances in February 2021, September 2024, and November 2024 all occurred when bitcoin was near all-time highs, not poor timing, but a belief in Bitcoin’s long-term value.

Strategy does not hold its bitcoin in self-custody; instead, it entrusts a significant portion of its holdings to third-party custodians. A recent report reveals that 98% of its bitcoin is kept with Fidelity Custody, with Coinbase Prime also used to diversify asset management and security.

In the past, Michael Saylor has said that Strategy uses “US-based, regulated, institutional-grade” custodians that are routinely audited and certified for their custodial practices. On the other hand, little is known about the specifics of how Strategy holds its bitcoin, which could expose it to potential cyber attack risks.

However, its centralized custody approach raises concerns about concentration risk and vulnerabilities, despite the measures in place to safeguard the assets.

I see this as the greatest risk, considering that no one knows which administration will come to power in the future. The confiscation of bitcoin held by centralized U.S. companies under government order is a possibility.

Lastly, I often hear people from Trad-Fi argue that Michael Saylor had no choice but to pivot to Bitcoin due to Strategy’s smaller size compared to the “Big 7” tech companies. However, they miss the whole point.

Globally, many companies face similar challenges with rising inflation and increasing capital costs. Bitcoin serves as a lifeline for productive companies, enabling them to weather the fiat madness of escalating costs and increasing monopolization.

Regardless, I urge everyone to conduct their own research, this piece is not investment advice. My aim is simply to explain in detail how the flywheel works.

All investments, especially those involving leverage, carry risks. The information provided here is for informational purposes only and should not be construed as legal, tax, investment, financial, or other professional advice.

WHICH CHARACTERISTICS MAKE COMPANIES WELL-SUITED FOR A BITCOIN TREASURY STRATEGY?

Often, adversity fuels innovation. Michael Saylor’s decision to pivot toward Bitcoin was not just a bold conviction but a strategic necessity, a last resort for continued success of the business intelligence company founded in 1989 and publicly listed since 1998.

After exhausting conventional corporate growth strategies, including launching new products, expanding product lines, cost-cutting, share buybacks, and marketing pushes, Strategy still found itself losing economic energy to fiat inflation.

Despite generating substantial revenue and maintaining positive cash flow, the company struggled to outpace the rate of monetary debasement.

If the money supply expands by 8% annually while a company’s cash reserves grow by only 5%, its real purchasing power effectively declines by 3%, destroying it over time.

Given how few have adopted a Bitcoin treasury strategy, it seems that only those who have personally experienced the challenges of the fiat system, where rising inflation and regulatory costs steadily erode business profitability, are fully prepared to embrace Bitcoin. Over time, there will likely be more, as inflation is an inherent part of the fiat system and will persist.

A crucial factor that enabled this shift was Saylor’s majority control over the company’s voting rights at the time, allowing him to implement the Bitcoin strategy decisively.

Before executing the transition to a Bitcoin standard, Saylor ensured that management and the board were open to studying Bitcoin, fostering alignment across leadership.

To further secure consensus and minimize opposition, he offered shareholders a buyback option (plus a premium), giving them an opportunity to exit before moving forward.

Bitcoin treasury strategies are particularly advantageous for smaller companies that provide real economic value, sustain jobs, and generate income for employees, but struggle to outpace competition or monetary inflation. These companies often hold cash reserves that yield negatively in real terms due to inflation.

A prime example of a publicly listed firm that followed in Strategy’s footsteps and reinvented itself with Bitcoin is Metaplanet, a Japanese company that pivoted from hospitality to bitcoin in the face of post-COVID regulations, inflation, and a weakening yen.

Metaplanet moved from immobile, physical real estate to borderless, digital real estate, preserving value, enhancing resilience, and positioning itself for growth.

With strong leadership, sharp execution, a disciplined treasury strategy, and strong retail investor backing, Metaplanet has transformed into a thriving Bitcoin-native enterprise.

In contrast, large corporations like Apple or Microsoft have more to lose by adopting a Bitcoin strategy prematurely. Operating in volatile sectors already, adding bitcoin to their balance sheets could amplify that volatility, potentially making their stock less attractive to institutional investors.

For example, if Apple held even a small amount of bitcoin and its price dropped by 60%, it could create unnecessary downward pressure on Apple’s stock, even if bitcoin represented only a fraction of its reserves, simply due to public perception.

Most investors in large corporations, where steady growth is expected, do not look favorably on this. These companies operate within the fiat system, providing investors with a sense of security.

Today, the “Magnificent Seven” function almost like indexes on U.S. tech-sector growth, allowing shareholders to keep pace with inflation. This is their current competitive advantage as equities in the fiat paradigm.

Additionally, large shareholders often use their equity stakes as collateral for further investments and prefer price stability, making bitcoin’s volatility a deterrent for major corporations at this stage.

Consequently, major corporations are less likely to adopt bitcoin early on, while smaller firms benefit from its volatility by attracting increased investor interest.

Over time, however, companies that adopt bitcoin as a treasury asset will outgrow those that do not, eventually becoming some of the largest corporations in the world with Strategy most likely becoming the largest firm in the known universe.

Along the way, their inclusion in major indexes like the S&P 500 will draw further attention to this profitable strategy, encouraging others to follow suit. At a certain point, it may even be seen as riskier not to hold bitcoin in corporate treasuries.

Also to AI companies like NVIDIA, which today still treat their data centers as their primary “treasury.” A combination of such infrastructure with Bitcoin, however, allows for far greater productivity and resilience. Overall, bitcoin in your treasury is the best way to make sure you won’t go out of business.

FINAL THOUGHTS

The speculative attack provides a good framework for understanding how Bitcoin can serve as a path to financial sovereignty, free from the shackles of fiat inflation.

The strategy involves borrowing fiat money to purchase bitcoin, leveraging the inflationary tendencies of fiat systems against the disinflationary nature of bitcoin.

The effectiveness of such attacks has only strengthened as fiat currencies have deteriorated, evidenced by soaring Debt-to-GDP ratios and unprecedented money printing, with one-third of all U.S. dollars in circulation created since 2020.

As Bitcoin's adoption increases, the speculative attack becomes self-reinforcing, rising demand for bitcoin drives up its price, which then attracts more speculation and adoption.

Strategy has pioneered using this method through equity and debt markets to bolster its balance sheet with bitcoin, setting a precedent that has spurred other companies like Metaplanet.

For companies struggling with stagnant growth due to monetary debasement, Bitcoin offers a viable financial strategy to not only survive but unlock new opportunities.

While some bad actors may exploit this trend, the benefits for the global financial system to build more resilience and small-cap companies seeking revitalization are substantial.

By adopting bitcoin as a treasury asset, these companies can reclaim financial sovereignty, shield their balance sheets from fiat devaluation, and position themselves for long-term growth, just as Strategy has demonstrated.

The transformation highlights that companies with strong leadership, ideally concentrated voting power, and a willingness to explore new paradigms are best suited to integrate bitcoin into their corporate treasury strategy.

As for the stock, there are good and bad times to buy Strategy. With bitcoin’s history of 80%+ crashes, the stock is not for those with weak hands. In addition, investors should be cautious when using it as collateral, as downside risk could lead to margin calls.

Strategy’s stock is volatile, with an average beta of 1.5x to bitcoin, meaning it outperforms in bull markets but drops sharply in corrections. Bitcoin will inevitably drop 60-80%, triggering panic, but Strategy’s debts will not increase.

This could provide long-term investors a chance to buy stock at a discount.

Experience shows that when Strategy’s share price falls below the value of its bitcoin holdings, it presents an excellent buying opportunity. Long-term investors can capitalize on bitcoin's volatility by accumulating shares when the stock trades below its bitcoin treasury value, essentially buying below net asset value.

Of course, holding Strategy stock isn’t the same as holding bitcoin directly, but for fiat investors seeking leveraged bitcoin exposure, there’s no better alternative.

This makes Strategym with its Bitcoin treasury strategy, broad range of offerings of bitcoin-backed securities for fixed income, an attractive vehicle for capital allocation, particularly for savers, high-net-worth individuals, and large institutions seeking indirect exposure to bitcoin or cash flow, while also navigating regulatory constraints, mitigating downside risk, and managing portfolio volatility.

The growth of Strategy illustrates the power of a well-executed Bitcoin treasury strategy in transforming corporate finance. This is nothing short of a revolutionary breakthrough, both in its impact and the unprecedented speed at which it has been executed.

Unlike Bitcoin, which is governed by code, Strategy is led by people who can make mistakes, and even die, highlighting the superiority of holding bitcoin directly, which can persist independent of a single person in perpetuity.

Nevertheless, understanding what Strategy does is essential for any entrepreneur, as it represents a revolution in corporate finance and appears to be the best option for gaining exposure to bitcoin through a fiat-regulated vehicle, if that’s what you’re looking for.

There is no free lunch, both Bitcoin and Strategy demand a strong commitment and a willingness to challenge conventional thinking.

Ultimately, what you do with that knowledge is up to you. But the need to explore alternatives to conventional treasury strategies, particularly bitcoin, will become increasingly relevant for everyone, from individuals and companies to nation-states.

This is especially true for property investment firms, including developers, residential and commercial landlords, shopping center owners and hotel operators, as the digitalization of value, which bitcoin represents, challenges real estate’s long-standing role as the dominant store of wealth.

WORTH TO KNOW

Podcast and publications

With Sovereign Origin, we’ve built a first draft of our Bitcoin & real estate portfolio estimator. Help us battle-test it! TRY THE MODEL. It highlights how Bitcoin can enhance project financing.

We’re optimizing for mobile and welcome your feedback.

Real Estate vs Bitcoin: The Truth No One Tells You In early March, I sat down with Bram to discuss the importance of resilient collateral as the foundation for a truly global financial system. We examined how Bitcoin and AI are vital for humanity’s continued success and discussed the need for property investors to develop and integrate Bitcoin strategies, since bitcoin represents the digitalization of value, a role that real estate has traditionally fulfilled since 1971. WATCH

Bitcoin Meets Real Estate: Unlocking The Ultimate Investment Strategy CJ Konstantinos has developed very interesting ideas regarding the use of bitcoin as collateral, illustrated by his firm “The People Reserve” and its self-paying bitcoin mortgage. We explored the difference between money and currency, discussed bitcoin’s ability to serve as collateral and talked about the potential future of a bitcoin-based financial system. WATCH

Bitcoin Podcast: Bitcoin ist der beste Wertspeicher für Immobilien The founder and CEO of the swiss/european Bitcoin app Relai, Julian Liniger and I had an exciting conversation on the German edition of his Relai - Learn Bitcoin podcast, where we discussed how Bitcoin benefits real estate investors. The discussion was insightful, enjoyable, and has received great feedback so far. WATCH (German)

Bitcoin Brief: The One Reason Investors Are Abandoning Real Estate for Bitcoin Marty Bent has been an incredible supporter of my message, helping me advocate for the importance of dual collateralizing real estate and bitcoin. This approach hedges against the scenario where real estate loses its status as the world's preferred store of value to bitcoin. It also strengthens the global financial system by anchoring it to bitcoin, the most pristine form of collateral ever known. In this clip, Marty breaks down the investment thesis on why Bitcoin is disrupting the $300 trillion real estate market and why investors are already making the shift. WATCH

Bitcoin Hotel: Verkaufe Bitcoin niemals

In this German podcast with Marc from Bitcoin Hotel, we discussed Bitcoin as collateral, Trump, Howard Lutnick, Tether, life, and the future of the U.S. dollar. The conversation took place a few weeks ago at Bitcoin Beach in El Salvador, an inspiring place for anyone who understands the true potential of Bitcoin. Tune in to hear my thoughts on why selling bitcoin for fiat is never an option. WATCH (German)

World Game: Leon Wankum | Digital Real Estate

This was a highly engaging conversation about the visionary ideas of Buckminster Fuller, their relevance to modern economic systems, and, of course, Bitcoin, housing, and real estate development. We explored how Bitcoin can function as a form of digital real estate, the concept of housing as a service, and the distinction between utility value and monetary premium in real estate. A thought-provoking and enjoyable discussion. WATCH

IDEAS OF INTEREST

Bitcoin As Property: What Perfection Looks Like with Michael Saylor | The Bitcoin Layer: Michael Saylor delivers a powerful case against real estate as a store of value and explains why Bitcoin will replace it. WATCH

Bitcoin University: Bitcoin, Stocks, Gold, and Houses (Store of Value): Matthew Kratter breaks down the relative merits of Bitcoin, stocks, gold, and real estate as stores of value, emphasizing Bitcoin's superiority as a portable, digital asset. WATCH

Michael Saylor CPAC 2025: Watch Michael Saylor's talk at the CPAC conference, where he discusses Bitcoin, freedom, and economic empowerment. WATCH

Michael Saylor Speech at Bitcoin Policy Institute “Bitcoin For America Summit” Saylor delivered one of his most interesting lectures on Bitcoin to date. This time, he discussed the necessity for the USA to pursue its own Bitcoin strategy. WATCH

Andrew Hohns_Bit Bonds: An Idea Whose Time Has Come: Full presentation by Andrew Hohns on how the US Government can purchase bitcoin in a budget-neutral manner through the issuance of bitcoin-backed bonds. WATCH

The Bitcoin Treasuries Podcast: Phong Le, President & Chief Executive Officer Strategy: Phong Le, President & CEO of Strategy joined the Bitcoin Treasury Podcast presented by Onramp Bitcoin. Recorded at the Strategy Headquarters in Tysons, VA, this episode offers exclusive insights into how Strategy is revolutionizing corporate treasury management with Bitcoin. An engaging conversation on innovation, strategy, and the future of money. WATCH

If you want to support me. Feel free. You can send me some satoshi/bitcoin.

Lightning: law@getalby.com

On-chain: bc1qyc9q89wjzmvaw729tj3wsrsfhft53mjycrjxdk

Nostr PubKey

npub1v5k43t905yz6lpr4crlgq2d99e7ahsehk27eex9mz7s3rhzvmesqum8rd9

Resources

Pierre Rochard - Speculative Attack READ

Pierre Rochard & Allen Farrington - Speculative Attack Season 2 READ

Leon Wankum - Is leveraging legacy assets to buy bitcoin a good strategy? READ

Leon Wankum - Bitcoin will completely change real estate markets and interest rates READ

Strategy - MicroStrategy Announces Pricing of Offering of 0% Convertible Senior Notes READ

Strategy - Q4 2024 Financial Results READ

Strategy - Strategy Announces Pricing of Strike Preferred Stock Offering (STRK) READ

Strategy - Strategy Announces $21 Billion STRK At-The-Market Program READ

Strategy - Strategy Announces Pricing of STRF Perpetual Preferred Stock READ

Strategy - Strategy Announces $2.1 Billion STRF At-The-Market Program READ

Strategy - Strategy Announces Pricing of Initial Public Offering of STRD Stock READ

Strategy - Strategy Announces $4.2 Billion STRD At-The-Market Program READ

Strategy - Strategy Announces Pricing of STRC Perpetual Preferred Stock READ

Strategy - Strategy Announces Closing of $2.521 Billion STRC Public Offering READ

Strategy - News and Press Release Archive READ

Strategy.com - VISIT

MSTR Tracker - VISIT

Microstrategy’s Bitcoin Strategy is to Keep BTC With Fidelity READ

Jesse Myers - Bitcoin's Full Potential Valuation READ

St. Louis FED - Average Sales Price of Houses Sold for the United States READ

Charlie Bilello - Price to earnings ratios READ

Photo Credit: The Bitcoin Flywhell was built with the help of Imke Wedekind and Diarie Said.

Disclaimer: the content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Make sure you do your own research before making any investment and be aware of your own risk tolerance. If you like to build on my thoughts, feel free, but please cite me as the source. 2025 - Leon Wankum.

Editing and content creation by Clemens Haidinger.

0A79 E94F A590 C7C3 3769 3689 ACC0 14EF 663C C80B

Top notch explanation and excellent comparison with regards to real estate and leverage! :-)