Real Estate Refinancing: The Economics of Leverage When Buying Bitcoin

The Bitcoin Newsletter 23

Welcome to the 23rd edition of The Bitcoin Newsletter,

Real estate developers usually refinance finished properties that have appreciated in price, using the capital for further developments or acquisitions. Instead of reinvesting in real estate, the funds obtained through refinancing can be used to purchase bitcoin.

As speculation shifts from real estate to bitcoin, real estate developers have a unique opportunity to leverage their portfolios to buy bitcoin. This strategy allows developers to benefit from bitcoin's price appreciation while maintaining cash flow from real estate to service the debt. The cash flow ensures the debt incurred to buy bitcoin is manageable, making bitcoin's volatility secondary. This approach leverages the strengths of both asset classes.

In the 23rd edition of The Bitcoin Newsletter, I will explore the economics of leveraging real estate to buy bitcoin and explain why this strategy makes sense for real estate developers with a long-term investment strategy. This chapter will be part of my upcoming book "DIGITAL REAL ESTATE". Therefore I would be happy about feedback. If you discover errors or things that seem illogical to you, please get in touch.

Best regards,

Leon

DEEP DIVE

Real Estate Refinancing: The Economics of Leverage When Buying Bitcoin

Real estate developers can refinance fully rented properties that increase in market value to fund bitcoin purchases, leveraging their cash flow from real estate to manage the debt and capitalize on bitcoin's long term price growth. By leveraging the strengths of both asset classes, developers can use the cash flow generated from real estate to service the additional debt incurred from purchasing bitcoin, while both the property and, most importantly, bitcoin continue to appreciate in value. This makes bitcoin's volatility secondary and ensures the debt remains manageable, allowing real estate developers to hold bitcoin long-term.

This approach enables developers to benefit significantly from bitcoin's price appreciation without having to sell properties. This strategy aligns well with my practical experiences in the real estate industry. From a Bitcoiner's perspective, selling all properties to buy bitcoin might seem logical. However, in my experience working with a relatively young real estate company, many of our completed properties remain heavily indebted. Selling these properties to capitalize on bitcoin's volatile price appreciation would be too risky and could endanger the entire business, which feeds and employs people who rely on their jobs to support their families.

Instead, the goal is to find a balance that leverages the strengths of both asset classes, ensuring financial stability and growth for the company and its employees. Also, if you have purchased real estate with the intention of holding it long-term and relying on its cash flow, this strategy can be highly beneficial.

The opportunity offered by buying bitcoin with reasonable leverage was laid out by Pierre Rochard in his article “Speculative Attack” (2014):

“The cost of borrowing (annualized interest rates ranging from 0% to 25%) is lower than the expected return of owning bitcoins. How leveraged someone’s balance sheet is depends on the ratio between assets and liabilities. The appeal of leveraging up increases if people believe that fiat-denominated liabilities are going to decrease in real terms, i.e. if they expect inflation to be greater than the interest rate they pay.

At that point it becomes a no-brainer to borrow the weak local currency using whatever collateral a bank will accept, invest in a strong foreign currency, and pay back the loan later with realized gains. In this process, banks create more weak currency, amplifying the problem.”

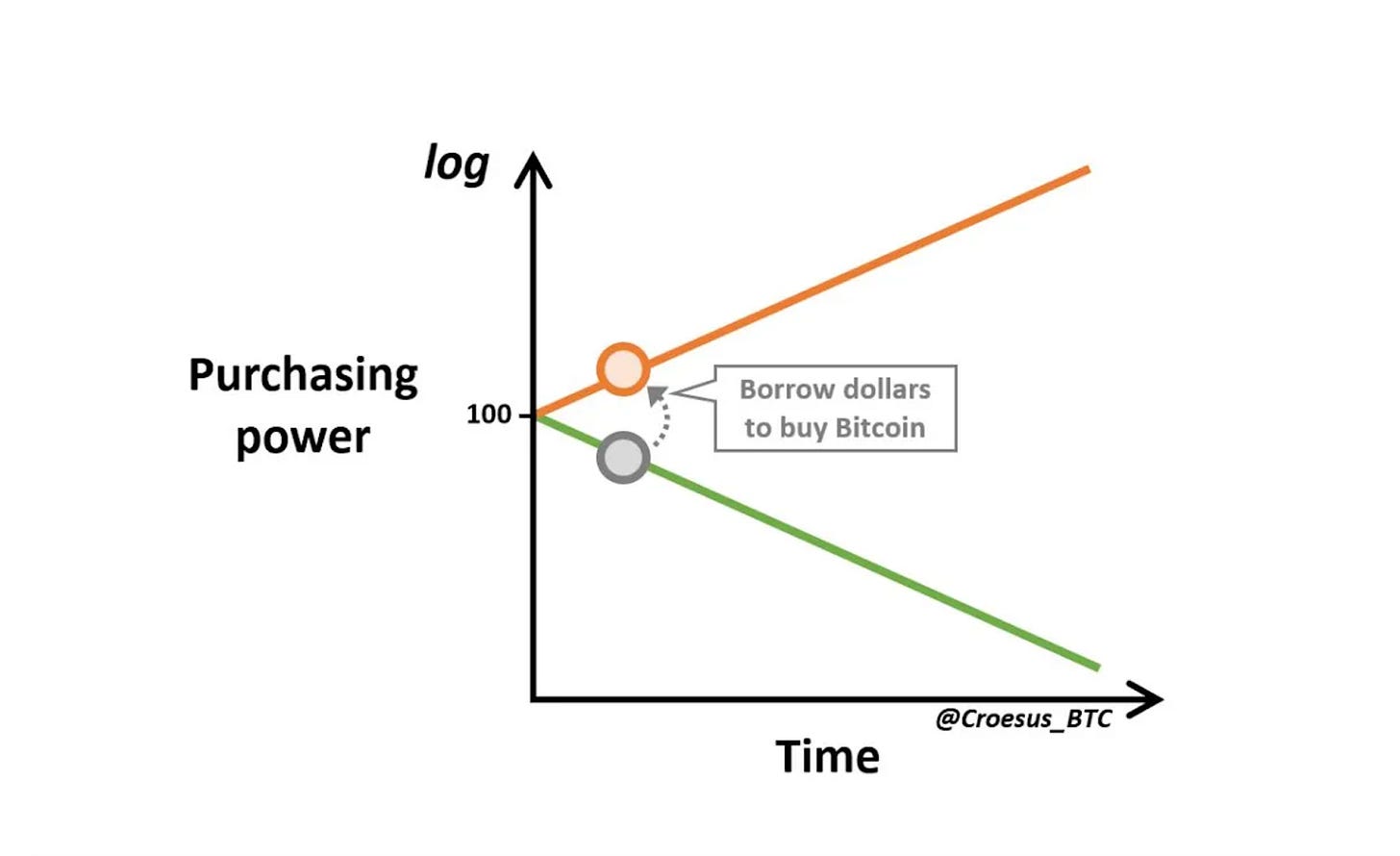

Pierre Rochard's article "Speculative Attack" outlines the concept of leveraging fiat-denominated debt to invest in bitcoin, given that the cost of borrowing is lower than the expected returns from bitcoin. This strategy uses an inflationary fiat currency to acquire a disinflationary asset, bitcoin, anticipating that fiat liabilities will decrease in real terms due to monetary inflation.

Over time, as inflation reduces the real value of fiat denominated debt, bitcoin's value appreciates due to its scarcity. Bitcoin, with its capped supply, continues to attract demand from those seeking to preserve their wealth. Debt denominated in fiat, i.e. state-issued currencies, that you take on today will lose value in the future while the price of bitcoin rises.

Fiat currencies are being printed at the push of a button at little cost, and their supply will continue to increase, while bitcoin’s supply is fixed at 21 million. Historically, all fiat currencies eventually go to zero, while bitcoin is engineered to increase in value forever.

Bitcoin’s appeal comes from the fact that its monetary policy is incorruptible and unalterable. This means that those who voluntarily choose to take on debt in an inflating currency in favor of a disinflationary and sound currency will be able to accumulate long-term-oriented capital. They will do so at a disproportionate rate compared to those who do not.

Michael Saylor, with MicroStrategy, has brilliantly demonstrated the use of fiat debt to continuously acquire bitcoin, creating a blueprint for others to follow. MicroStrategy's valuation has soared to nearly $30 billion in 2024, just 48 months after the strategic shift. Before this, the company's market valuation was under $1.3 billion.

Real estate developers are experts at raising capital, usually for the purchase and development of new properties. Using existing real estate to incur debt and buy bitcoin may be an even bigger business opportunity, as the price of bitcoin is likely to grow significantly faster than real estate over the long term due to its absolute scarcity and its position at the beginning of its adoption cycle.

Refinancing real estate can be an effective way to lock in unrealized equity from the property's market value increase and existing debt repayment, while simultaneously building bitcoin holdings. Taking advantage of bitcoin's appreciation while managing operating debt with consistent cash flow from real estate represents a strategic method for long-term growth.

Example of Refinancing a Property Owned by a Medium-Sized Real Estate Development Company:

Consider Company A, a medium-sized real estate developer with a fully rented 68-unit apartment building. We assume that Company A constructed the building for $11,000,000, using approximately 30% equity ($3,000,000) and securing a $8,000,000 loan at an interest rate of 4.25%. Once fully rented, the property generates $750,000 in annual rental income and is valued between $11,250,000 and $15,000,000 based on a 15-20x yearly rental income multiplier (the CAP rates would be 6.67% and 5% respectively).

Company A can refinance by taking an $11,000,000 loan, repaying the $8,000,000 construction debt, and using the additional $3,000,000 to buy bitcoin. However, this strategy is sensitive to interest rate changes, as rising rates can strain finances. Projects initially financed at considerably low interest rates, given the historical 10-year average (e.g., 4.25%), could face significant financial stress if refinanced at higher rates (e.g., 6-8%). This scenario could reduce cash flow and potentially lead to bankruptcy in the worst-case scenario.

To mitigate this risk, Company A could take an additional $1,000,000 loan with a 10-year term at 6-8% interest, using the property as collateral. The longer the loan term, the better. Spreading out a loan for as long as possible means lower monthly payments, providing more time for bitcoin to grow in value and increase your purchasing power. For simplicity, the situation described is for an "interest-only" loan and not a fully-amortizing loan (interest + principal).

Loan Details and Bitcoin Investment:

Initial $8,000,000 Loan at 4.25% Interest:

Annual interest: $340,000

Additional $1,000,000 Loan at 6-8% Interest:

Annual interest: $60,000 - $80,000

Total Interest Charge:

$400,000 - $420,000

Rental Income after Interest:

$330,000 - $350,000

While bitcoin has shown an average annualized return of 60% over the last ten years, we can expect the year-on-year growth rate to slow down over time as bitcoin grows in market cap. This gradual decrease in growth rate reflects the typical pattern observed in maturing assets. Assuming that bitcoin grows at an annual rate of 40% over the next 10 years and 20% over the subsequent 10 years, a $1,000,000 investment in bitcoin at $100,000 per bitcoin would increase to approximately $28.9 million in 10 years and around $179 million in 20 years. Comparing these numbers to a leveraged investment in real estate highlights the clear superiority of bitcoin.

Let's consider a house worth $1,000,000, purchased with 20% equity ($200,000) and an $800,000 mortgage loan at 5% interest. For simplification, we will not account for rental income, property taxes, or loan redemption when repaying the loan. Additionally, we are not considering the operating expenses for managing these properties. In the US, the rule of thumb is that management expenses are approximately 30% of gross rent, e.g., $30,000 of expenses for every $100,000 of rent. This concept is known as the Debt Service Coverage Ratio (DSCR).

Historical data shows that residential real estate in the US has grown at an average annual rate of 5.7% since 1971, while commercial real estate has grown at 4.4%. Please note that this example does not account for volatility or years of negative growth; it is a simplified example using yearly averages for illustrative purposes.

Comparison: Real Estate (US) vs. Bitcoin Investment

Residential Real Estate Growth (5.7% annual):

10 years: $1,000,000 → $1,744,400

20 years: $1,000,000 → $3,043,980

Commercial Real Estate Growth (4.4% annual):

10 years: $1,000,000 → $1,537,700

20 years: $1,000,000 → $2,363,000

Bitcoin Growth:

10 years (40% annual): $1,000,000 → $28.9 million

20 years (20% annual after first 10 years): $1,000,000 → $179 million

The comparison illustrates bitcoin's superior growth potential compared to real estate, highlighting the financial advantage of leveraging bitcoin's exponential appreciation. By combining real estate's cash flow and bitcoin's value storage capabilities, developers can create a more robust portfolio.

When done with caution, the right mindset, an appropriate time frame, and in proper sequence, this powerful combination can supercharge a real estate business. Ultimately, this benefits consumers, who have been particularly burdened by rising housing costs due to monetary inflation. Real estate developers can capitalize on bitcoin's price appreciation, which acts as an inflation hedge, rather than solely relying on increasing rent to offset higher construction and maintenance costs due to monetary inflation. This enables the continuous development of high-quality products at affordable prices and maintain more stable rent prices. This is another example of how bitcoin can help improve everyone's standard of living.

This strategy can be implemented incrementally, step by step, to continuously tap into the illiquid capital in real estate and leverage it into bitcoin over time. Sensibly using real estate as collateral to borrow and buy bitcoin addresses a significant issue: liquidity. Real estate is an illiquid and immovable asset. Using immovable liquidity in income-generating real estate to buy bitcoin can be a good option to protect wealth from destruction or confiscation, should one need to relocate. This strategy is becoming increasingly important as we witness growing tendencies toward totalitarianism globally, which historically have led to the oppression of minorities, including property confiscation and other forms of asset seizure.

In conclusion, integrating bitcoin into real estate financing strategies allows developers to capitalize on bitcoin's potential while maintaining the security and cash flow of their real estate investments. This balanced approach provides long-term financial stability and growth, ensuring real estate businesses can thrive in the evolving digital economy and tenants have affordable living spaces.

PS: I would like to thank , also known as Kelly Lannan, for his extensive feedback.

WORTH TO KNOW

Podcast and publications

BTC- Echo: How to make your dream of owning your own home possible with Bitcoin

The German publication BTC-Echo published an interview with me, recorded following my talk in Prague, in which I talk about how you can make your dream of owning a home possible using Bitcoin. READ

IDEAS OF INTEREST

MIT Bitcoin Expo 2024: Scaling Up - The Halving with Jesse Myers (Onramp) - A comprehensive look at the Bitcoin halving. What it is, its historical significance, and its impact on the price of Bitcoin. WATCH

The US Literally Cannot Repay Its National Debt - The Congressional Budget Office has admitted that the US national debt cannot be repaid. So what's the solution from the US Government and Federal Reserve, will this weigh on the election, and what will the result be for the stock market? WATCH

Compute Maximalism: The Symbiosis between Bitcoin Mining and A.I. - A look at how Bitcoin mining and AI can work together to create streamlined data center operations and facilitate efficient power grid management. READ

Audio Mises Daily: Isaiah’s Job (The Remnant) - An element in Judean society that was particularly worth bothering about was the Remnant. Isaiah seems finally to have got it through his head that if anything substantial were ever to be done in Judea, the Remnant would have to do it. This is a very striking and suggestive idea: do the best you can and trust that it will be understood and appreciated by those it is meant for. LISTEN | READ

Michael Saylor: Bitcoin as the Key to Solving Economic Challenges and Creating Unprecedented Wealth - Michael Saylor argues that Bitcoin is the key to solving economic challenges, presenting it as a superior, long-term asset compared to traditional financial and physical assets. His talk provides valuable insights and concrete examples on Bitcoin strategies, showing its potential for unprecedented wealth creation in a digital world. WATCH

If you want to support me. Feel free. You can send me some satoshi/bitcoin.

Lightning: law@getalby.com

On-chain: bc1qyc9q89wjzmvaw729tj3wsrsfhft53mjycrjxdk

Nostr PubKey

npub1v5k43t905yz6lpr4crlgq2d99e7ahsehk27eex9mz7s3rhzvmesqum8rd9

Resources

Pierre Rochard - Speculative Attack (2014) READ

Jesse Myers - Asset DNA: The Diverging Performance of Store-of-Value Assets READ

Market capitalization of MicroStrategy (MSTR) READ

St.Louis FED - Median Sales Price of Houses Sold for the United States READ

St.Louis FED - Commercial Real Estate Price Index, Level READ

Leon Wankum — Bitcoin and Real Estate (BTC Prague 2024 Keynote) WATCH

Photo Credit: Ian Simmonds (ihs_photo)

Disclaimer: the content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Make sure you do your own research before making any investment and be aware of your own risk tolerance. If you like to build on my thoughts, feel free, but please cite me as the source. 2024 - Leon A. Wankum.

Editing and content creation by Clemens Haidinger.

0A79 E94F A590 C7C3 3769 3689 ACC0 14EF 663C C80B

I really enjoyed this article Leon. The small investment in Bitcoin is worth more than the property over 10-20 years. I’d be interested to hear how you present this to non Bitcoiners. Looking forward to our discussion.

Very interesting business plan for individuals as well as reality firms. At good locations in any Countries very good business oportunities with nice profit and mainly longterm accumulating wealth to future BTC✔️